Search the Community

Showing results for tags 'guidance'.

-

My Mother is 96 and has had a M&S CC for many years, used for phone and online shopping which also gave her a feeling of independence as she rarely left the house. She began displaying signs of dementia late last year following a stroke, then fell at Christmas suffering a v serious head injury and was not expected to survive. She was eventually stabilised, though only after two scary doubt-filled relapses. It was then immediately clear that her dementia had deepened v substantially, and to make a long and very evil story short my Mother has in just a few weeks been replaced by someone who looks like her but has no memories, doesn't retain anything she is told conversationally for longer than 30-60 seconds, has no retained awareness therefore of her circumstances or where she is, who never has a yesterday to help her understand today, is confused on a good day and distressed on a bad one, doesn't recognise friends/some-family, and only occasionally recognises me when I tell her who I am. She is now in permanent residential dementia care where we continue to visit a very frail stranger unable to look after herself and needing help with all aspects of daily life, and that we love very much but can do nothing to help, only ... observe. Anyway ... I am dealing with her personal affairs. I would like to know please whether a card-issuer - M&S in this case - has legitimate recourse to family if the card-holder is neither competent nor capable and is unable to settle an outstanding balance, in this case just under £2K. Today the State takes all of Mum's pension and benefits to offset some of the £900+ p.w. cost of her Care, with the exception of a few pounds as so-called pocket-money to provide "personal treats" like toothpaste and replacement clothes/undies etc. Treats? There is no longer any possibility of the outstanding balance being settled by Mum from any source at all, she has no assets and had been getting by just okay on her State Pension+ small benefits whilst in a sheltered-housing bungalow since my Father died. I have been far too preoccupied to bother with the M&S reminder-letters over the past three months, but should take control before things escalate. I don't have any problem ignoring DCs if M&S moves it along, however I'd rather put the brakes on with M&S before that stage. So, to repeat my question ... I assume that in Law M&S would have recourse to income or assets, however there are none and I am wanting to know if In Law there is then permitted-recourse to family for the debt? If they try to make noise instead of writing the balance off, I am perfectly capable of berating M&S very robustly about pursuing a 96 year old woman in residential care with dementia! However, before then I want to be clear in my mind about the legitimacy of any other channels they may claim to be entitled to pursue for recovery. In reality they would actually be unsuccessful that way also as I am 71, retired with no assets and only state pension income, and with debts and obligations of my own already after a past business-collapse. I'm not concerned with that just now however, just in knowing whether M&S would be on solid ground if they should respond by saying that in these circumstances the debt becomes the responsibility of someone's family to settle if their assets/estate isn't able to cover it. So can someone advise on that one point please? Thanks! Howard

-

New guidance to support staff engagement during insolvencies READ MORE HERE: https://www.gov.uk/government/news/new-guidance-to-support-staff-engagement-during-insolvencies

-

- during

- engagement

-

(and 4 more)

Tagged with:

-

Could someone please advise on the “6-years and it lapses” rule, I want to know if it still is in place, and also if it then has relevance for the following. 5 years ago I acted on advice from the wonderful people on this forum. I had previously retired at 65 after a business collapse, and was facing constant letters/calls from debt collectors regarding some related debts amounting to £36K across 5 business credit cards, 1 personal card, and a small-business loan. As a result of great advice I was able to hold my ground and even go on the attack, and after a year or so 4 of the debts were wiped out and a 5th “will not be pursued until we can furnish a copy of the original agreement”. That DCA was a total shambles, so that seems extremely unlikely 4+ years later still. My query today relates to the personal credit card, which was being dealt with by DCA 1st Credit. I offered a token payment of £5/mth because at that time I had not discovered this forum and had no idea that the financial sector worked in such heavily self-serving ways, nor that I had options. The offer was accepted and I made 3 payments, though by that point I had found this forum which opened my eyes wide! I wrote to 1st Credit notifying them that the credit card issuer had not dealt acceptably/completely with previous concerns (long story!), that I would not be making any more payments, that they should return the case, and that I would be contacting their client seeking proper action and that they would be included in any subsequent formal complaint themselves if they continued collection processes in the meantime. Other than asking for details once, which I ignored, I never heard from them again. I have now received two letters a few weeks apart advising “1st Credit has now become Intrum UK Ltd”, requesting a payment arrangement for that debt. I don’t know whether 1st Credit just changed their name, or Intrum Justitia (one of ‘my’ earlier DCAs) has bought their book, but either way it seems 1st Credit just shoved it to the back of the shelf 5 yrs ago, not returned it nor done anything with it themselves. My knee-jerk is that if the 6-year rule still applies, they are now trying to resurrect the case before it lapses. Part of me says to ignore them and see where it goes, though another part of me wants to snap-back setting a line of defence advising Intrum to return the case to the card issuer who I am contacting requiring them to deal properly with already-notified matters that they have yet to complete, with a warning of a formal complaint should they continue to chase. I’d greatly prefer getting to a 6 year cutoff however and just washing my hands of the whole stressful matter, than opening a level of formalities all over again and having all the stress for a year at least and most likely on in to our mid-70s. I’d just like to get on with living, as all was extremely upsetting to my wife who was/is not a strong woman after losing all our assets, our house and a second property, and living hand-to-mouth on just our state pension in rented accommodation and not the comfortable retirement we had expected. So regarding the “6-years” rule, is it still in force? If so, would contacting fresh-face Intrum with a stand-down notification letter end the 5 year lack of any contact just a year before it could help close the door? Or maybe has that already been ended with the appearance of Intrum asking for an arrangement, beginning a fresh 6-year requirement? So … should I ignore Intrum’s contact for a while longer, or get in quickly with a defence by going in to attack mode which no doubt would drag out for at least a year … by which time the 6 year rule would apply anyway if it is still in place as a potential backstop as long as I don’t break the silence? I would welcome some focus so I can see more clearly what makes the best sense … and also any pointers to new or changed legislation/codes-of-conduct /proper forms-of-words/etc that may be keeping me unknowingly out of step with things these 5 years later. Many thanks if you can guide me at all.

-

Crime news: revised Crown Court fee guidance READ MORE HERE: https://www.gov.uk/government/news/crime-news-revised-crown-court-fee-guidance

-

- county court

- crime

- (and 5 more)

-

I was really worried, I get caught for shoplifting at tkmaxxx. I have given my address, name, phone number and signed the banning form with exclusion list of stores for 12 months and a letter with RLP that I need to wait to pay them a lost cost of Tkmaxx which they have gotten all the goods back worth 60 Pounds. What will happen if I pay them? Will there be any further problems in the future? I am really ashamed of myself It happened because i'm not myself that day and suffering from depression from most of everything in my life. I really need some advice and help. Thank you

-

Guidance MOD confidential hotline READ MORE HERE: https://www.gov.uk/guidance/mod-confidential-hotline

-

- confidential

- guidance

-

(and 2 more)

Tagged with:

-

This is my first post so hope format is ok. I took out MBNA credit card (as Abbey National member) over 10 years ago following a change in financial circumstances was unable to make the repayments. I entered into an agreement to pay £1 a month to MBNA and a number of other creditors in 2010. My total unsecured debt is over £50k, and debt to MBNA was approx £16k. This debt was moved on to Aktiv Capital then to PRA Group. I have made these £1 payments since 2010 to all 3 organisations (I believe there may also have been another company in between MBNA and Aktiv but can't find details to confirm) Early this year I received a request from PRA litigation dept requesting payment of outstanding sum on an Abbey National card card or offer of repayment plan. The debt appears larger than I recall at 18600 appx. I responded to confirm circumstances unchanged and couldn't pay the o/s balance. I also requested they send me a copy of the CCA, as they were vague on start date. They have not sent the CCA but have issue court proceedings. I have completed and Back of service and confirmed I intend to defend all of the claim. I gather from forums I now need to issue a CPR, but I'm unsure which CPR to refer to. I've seen ref to CPR 18 but also CPR 31. Which should I refer to and is there a template letter I can refer to or use. At this point it appears to be in house PRA litigation taking action and not solicitor on their behalf so should I send CPR to the litigation department plus separate request to PRA for CCA. Its not clear on court N1 which address I send CPR to as address is PRA Bromley but litigation dept letter came from Scotland address. Any guidance would be appreciated.

-

There continues to be confusion about the charging of 'multiple fees' by bailiffs when enforcing more than one warrant (or Liability Order) at the same time. This confusion has lead CIVEA (Civil Enforcement Association) to seek legal opinion on the subject and as a result, they have issued the following Guidance to all their members. CIVEA Guidance Notes are designed to address issues which have arisen on the proper interpretation and implementation on a particular part of the regulations (in this case, 'multiple charging'). PS: CIVEA represent the interests of all private certificated enforcement agents in England and Wales. http://www.civea.co.uk/editorimages/Multiple%20Instructions.pdf

-

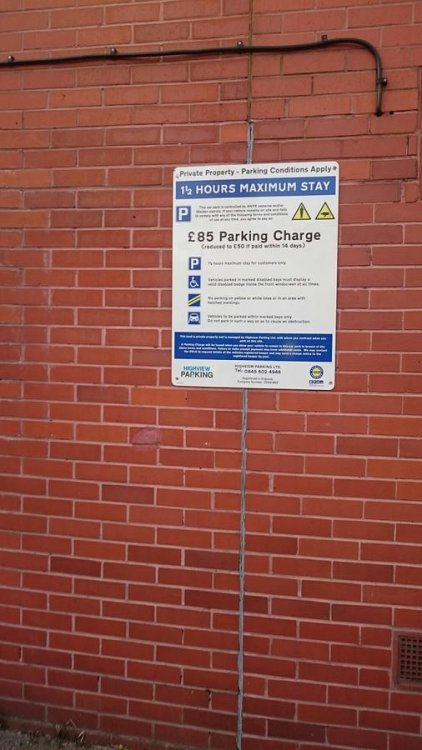

Hi Every one I had received a parking ticket for allegedly parking in a restricted area (client permit area) from High view parking. to further explain, we wanted some new carpets and went in a shop in hillsborough in sheffield which allows free customer parking. We parked in an area where there was a board of customer parking on the wall that i parked against, on the adjacent wall there was permit parking board. I genuinely thought it was customer parking, parked only to get a notice that i had parked in restricted area which was for clients only from high view parking. I stayed there for 17 mins. they had camera to prove i entered and stayed in what they say was a restricted area. i appealed to them initially really not understanding difference between client & customer saying my visit was for a genuine reason and they could cross check it with carpet shop. (my stupidity) and it got rejected , no surprise. I wrote to popla and giving them the explanation that the signage suggested customer parking, and there was ambuiguity and had it been more clear i would have not parked in the area. Popla has replied back saying it was still my fault to park there. I tried uploading my evidence but the website would not allow (technical problem) and than popla would not accept my pictures as case was submitted. What do i do now. ? As submission to popla, highview parking submitted a document delineating the various signage they have, but not mentioning that they have a misleading sign board in the restricted client area. Feel the decision is unfair, as i feel there should never be misleading signs. i dont know the laws regarding misleading signs in a private parking. I have now received a notice to pay £125 in 14 days. Should i take them to court ? because i still feel my case was not fully heard by POPLA. i have emails from POPLA where i have tried to convince them on allowing me to give them picture evidence but they have rejected it. ANy advice or help will be useful. attached is the picture of the area and signage

-

The following PDFs are the MOD Guidance on: Guidance notes for Service Personnel applying for a mortgage Guidance notes for Service Personnel when applying for Unsecured Credit FOI201600147_Annex_D_Guidance_Notes_for_Service_Personnel_Applying_for_a_Mortgage.pdf FOI201600147_Annex_C_Guidance_Notes_for_Service_Personnel_Applying_for_unsecured_credit.pdf

-

The Financial Conduct Authority has taken over from the OFT. You can find all you want to know about Debt Collection Guidance, etc HERE Also in the CAG Library HERE

-

- authority

- collection

-

(and 3 more)

Tagged with:

-

Hi, I was hoping someone would be happy to share the process of getting Bryan Carter Solicitors LLP to consent to my CCJ being set aside. The court date of the CCJ was 06/08/2014 for £546. I have been living abroad outside of the uk since January 2014. I only found out that I had this CCJ when I decided to check my credit report. Got email confirmation from the court only in October 2015. The original debt was for a Vanquais credit card. Lowell Group are the listed claimant on the CCJ. When I contacted them they told me to get in touch with Fredrickson International. And from there I was directed to Bryan Carter. A repayment plan is set up with Bryan Carters for £50 p/month. Which I intend on paying back as take responsibility for the debt. But the CCJ is going to ruin my credit rating and I think because I wasnt in the country at the time I should be able to get set aside. Is that true? I more or less grasp the process of completing the N244 form but I more interested in understanding the best way to get a letter confirming the Consent of the Claimant. I am not sure which one to even contact to ask for it. And would anybody have a template or guidelines to at least attempt making one myself, which I can share later. Also what type of evidence would I need to show? and would i need to appear in person? I was hoping the proof of me not being in the country and the claimants consent would mean not but if someone oculd clarify that would be great, thanks

-

A week or so ago a regular contributor on here (Dodgeball) started a discussion thread on the subject of when a bailiff should legally be able to charge a 'Sale Fee' of £110. The importance of this subject prompted me to approach CIVEA (The Civil Enforcement Agency) and yesterday they provided me with a copy of their official Guidance Note on the subject. A copy of this should be featuring on their website this weekend. Dodgeball's important and interesting thread on this subject has run to 5 pages and with 100 replies, I thought that this Guidance would get better publicity if it was posted on a separate thread. The original discussion thread can be found under the following link: http://www.consumeractiongroup.co.uk/forum/showthread.php?453200-Removal-for-sale-fee-when-can-it-be-charged

-

I have a question regarding some of the entries in the Halsbury's Statutes 4th edition at book 13 page 791 to 796. Parts 1-[723] - 6 at [732] does any of this help at all with the more modern act taking control of goods act 2013? Namely the following 4 Exclusion of certain goods [731] 4a Hire purchase etc. agreements [732] Can anyone explain a little bit more on this please?

-

Today, following a review of TV ads for payday loan products, we are publishing new Guidance to prevent ads trivialising the serious nature of taking out short-term, high-cost loans. The Guidance clarifies the spirit in which the rules must be interpreted, particularly the rule that requires ads to be responsible to the audience and to society. For example, ads should not encourage consumers to make an ill-considered or rushed decision about borrowing, particularly without considering the financial implications of doing so. In the light of research by the Children’s Society and evidence submitted in response to a call for evidence, we will now publish a public consultation on scheduling of TV ads for payday loans. The consultation will be launched by the end of July 2015. Read More

-

Good evening this is my first post to this forum. I am looking to send some f and f letters to DCA's in the week, can anybody advise on what level I should aim at I was thinking starting at 20% of outstanding balance. Can people give me an idea of their experiences/successes. Cheers

-

Hi there, first post so I hope it makes sense... Can anyone give me a brief understanding of section 15 of the Equality Act 2010 please (in layman's terms) as I'm trying to help my sister with a work problem and I think it might be relevant. She is a member of a union but they haven't been much help! It's relating to an actionable attendance policy at her work. She is disabled under the definition of the act and is employed by a large public sector organisation. She is rarely off work except with disability-related sickness (this has happened 6 times in the 24 years she has worked for them) and when she is it always lasts a few months and therefore breaches the policy guidelines, even though they relax the rules slightly for disabled employees. i.e. in one year Policy - 3 periods or 8 days Disabled employees usually 4 periods or 11 days She has been in work for 22 months without any sickness but then was taken ill and has been off for eight weeks and is due back at the end of March on a return to work plan (reduced hours for five weeks and weekly management meetings). She went to a sickness meeting last week and was told in passing that they will not put up with this level of sickness anymore and mentioned capability. She always takes personal responsibility for her health, takes her meds, lets manager know if a problem is developing, goes to the doctors/counselling etc. My question is that because of her disability when she is of sick she has always broken the actionable attendance policy which puts her at risk of being dismissed. Would it be reasonable to ask that her attendance be ignored under section 15? Just as an aside she has been off with depression and anxiety caused by work related stress. Any help would be much appreciated. Thanks Dex

- 23 replies

-

Hi, below i have paste information from the Scottish gov. website. If you are thinking of defending a repossession procedure and that you are not able to get legal aid, you cant afford a solicitors, you can get a Lay Representation to speak on your behalf. You can contact the Scottish Shelter to help you. At the moment i am at the early stage with my bank, they are threathening me with calling up notice if i dont pay up debt over £200,000.00 ( 3 accounts ) two account they cannot produce credit agreement documents. This dispute being going on for 6 years. Home Owner and Debtor Protection (Scotland) Act 2010: Guidance on Lay Representation Introduction/Background 1. This guidance relates specifically to section 24E of the Conveyancing and Feudal Reform (Scotland) Act 1970 (the 1970 Act) and section 5F of the Heritable Securities (Scotland) Act 1894 (the 1894 Act), as introduced by the Home Owner and Debtor Protection (Scotland) Act 2010 ("the 2010 Act"), and the Lay Representation in Proceedings relating to Residential Property (Scotland) Order 2010 (the Order), which allow for the lay representation of home owners and entitled residents in court proceedings for possession of residential property (including recall proceedings). 2. In early 2009, in response to the economic downturn and consequent rise in repossessions, the Scottish Government convened a Repossessions Group, as a sub-group of the Debt Action Forum, to consider whether protection for Scottish home owners facing repossession was sufficient. Members of the Group represented a wide range of interested parties, including representatives from the Council of Mortgage Lenders, the Finance and Leasing Association, the Scottish Law Commission, Shelter, Citizens Advice Scotland and the Scottish Legal Aid Board. The Group made a number of recommendations to strengthen protection for home owners, which were taken forward through Part 1 of the Home Owner and Debtor Protection (Scotland) Act 2010, to: require all repossession cases to call in court; require lenders to demonstrate to the court that they have considered reasonable alternatives to repossession; and enable home owners to be represented in court by approved lay representatives. 3. Paragraphs 5.3 to 5.14 of the Repossessions Group Final Report, published in June 2009, recognised that the repossessions process, in particular a court appearance, can be intimidating for home owners faced with repossession. The Group acknowledged that there was a need to improve arrangements for assisting those individuals affected by the formal procedures, including better access to information, but also better access to the full range of appropriate advice and representation providers. It was felt by the Group that there were particular issues about enabling access to representation, and that the existing restrictions on rights of audience exacerbated problems. Individuals who did not qualify for legal aid and could not afford to instruct a solicitor were faced with the prospect of appearing at court as an unrepresented litigant. The Group recognised that non-solicitor advisers were limited in what they could do in such cases, and identified that it would be helpful if experienced providers of lay advice and representation, where appropriate, were allowed to play a larger role in helping unrepresented litigants in the court process. 4. To tackle these issues, the Group recommended that there should be statutory change to enable home owners to have the option of being represented in court by approved lay representatives as well as solicitors. This would make the court process more accessible and encourage more people to take advantage of the legal protection on offer. 5. Section 24E(1) of 1970 Act and section 5F(1) of 1894 Act allow for the debtor or entitled resident to be represented by an approved lay representative in court proceedings in relation to a creditor's application to exercise the remedies available on default by the debtor in respect of a security over residential property, including repossession, (extending to recall proceedings under sections 24D and 5E respectively of those Acts), except in the circumstances which are prescribed by Scottish Ministers. 6. Secondary legislation prescribes those persons and bodies which may approve lay representatives. Those individuals approved as lay representatives will be required to satisfy the Sheriff throughout the proceedings that they are a suitable person to represent the debtor or entitled resident and that they are authorised to do so by that individual. 7. The provisions introduced by the 2010 Act essentially introduce rights of audience for approved lay representatives to defend proceedings related to applications for creditors' remedies on default, including repossession. It should be noted that the Act does not confer an automatic right on debtors and entitled residents to such representation, nor does it mean that an approved lay representative is obliged to participate in all proceedings. Nor can an approved lay representative act for a creditor. 8. This guidance is primarily directed towards those persons or bodies who are prescribed for the purpose of approving lay representatives, but is also relevant for approved lay representatives. The guidance explains the role of a lay representative and the competences expected of an approved lay representative. It is intended to aid prescribed persons or bodies in approving lay representatives. 9. The guidance sets out advice on how prescribed persons or bodies should approach the approval process, and importantly how organisations should seek to manage the provision of lay representation so that the individual client receives appropriate assistance from the appropriate adviser. This may in some instances mean that it is more appropriate for the individual to receive assistance from a solicitor than from a lay representative due to the complexity or the type of case that is involved. What is a Lay Representative 10. Section 24E(3) of the Conveyancing and Feudal Reform (Scotland) Act 1970 , and 5F(3) of the Heritable Securities (Scotland) Act 1894 define a lay representative as an individual, other than an advocate or a solicitor, approved for the purposes of that section by a person or body prescribed, or of a description prescribed by the Scottish Ministers. That definition is filled out by Article 3 of the Order, as set out in paragraph 20 below. The Role of a Lay Representative 11. Previously, in repossession proceedings, there was a limit to what non-solicitor advisors could do. The only individuals with rights of audience to represent and participate in the proceedings were solicitors or advocates. The provisions introduced by the 2010 Act mean that lay representatives also have these rights of audience, so that any debtor or entitled resident involved in these proceedings can have a lay representative acting for them if they so choose. However, prescribed persons or bodies should ensure that approved lay representatives are clear about the extent to which they can and should be acting in any specific case or circumstance. Lay representatives should be clear about the point at which they are not competent to deal with a specific case or a particular aspect or legal process, and should refer cases where appropriate to a solicitor who is skilled and knowledgeable in this area, or to another lay representative with the relevant skills and knowledge either in their organisation or another advice agency. It is expected that lay representatives will not normally charge for their services. 12. Standard 4.3 in Section 1 of the Standards, refers to referral arrangements. It is recommended that approved bodies, whether accredited or not, adopt arrangements such as are envisaged by this standard. If in the opinion of the lay representative the circumstances are such that the individual would benefit from legal advice, they lay representative should consider referring the individual to a solicitor and remind the individual that they may be eligible for legal aid. The lay representative should therefore be familiar with the financial eligibility requirements 1 of legal aid. 13. The legislation defines the term "lay representative" for repossession proceedings, with a view to both protecting the debtor or entitled resident, and to ensuring that court business proceeds smoothly. Only individuals who have the appropriate skills and knowledge to understand the proceedings and to represent individuals effectively may be approved to act as lay representatives. Someone who does not understand the relevant court proceedings or legislation is not equipped to be able to represent the interests of debtors and entitled residents properly in court. 14. Other people such as a friend, spouse or colleague can in some instances attend court proceedings to support individuals but this is distinct from the active role of the statutorily defined lay representative, and they will not have the right to participate in repossession proceedings on behalf of the individual. Satisfying the Sherriff that you are competent to be a lay representative and authorised to do so. 15. Section 24E(2) of the Conveyancing and Feudal Reform (Scotland) Act 1970, and 5F(2) of the Heritable Securities (Scotland) Act 1894 require that an approved lay representative must throughout the proceedings satisfy the Sheriff that: he or she is a suitable person to represent the debtor or entitled resident; and he or she is authorised by the debtor or entitled resident to do so 16. In line with this requirement an approved lay representative will need to be prepared to demonstrate to the Sheriff that they are competent and authorised to appear before the Court as a lay representative. Approving organisations are encouraged to provide their local courts with a list of persons approved by them to act as lay representatives along with letters of confirmation of approval that individual lay representatives can show the Sheriff if required. This should be done in advance of any hearing in order to inform the Sheriff that such individuals are competent to appear in court. 17. It is strongly recommended that approved lay representatives also obtain written confirmation that they are authorised by the debtor or entitled resident to act on their behalf, which can similarly be provided as documentary evidence for the Sheriff if required. 18. Prescribed bodies or persons approving lay representatives should ensure that those individuals approved to act as a lay representative are aware that the Sheriff is responsible for ensuring efficient use of court time. This means if the Sheriff considers that the lay representative is not a suitable person to act on behalf of the debtor or entitled resident, and therefore that it is not in their interests for this person to continue to represent them, then the Sheriff may discharge the lay representative and they would no longer be able to take part in the hearing. 19. Such discharge and any resulting postponement of the proceedings would be extremely inconvenient for all concerned and the costs involved with postponing are likely to fall on the debtor. It is therefore important that approving organisations ensure that all lay representatives approved meet the criteria to demonstrate that they are competent. Prescribed persons or bodies for the purposes of approving lay representatives 20. Individuals can act as lay representatives so long as they are approved as such in accordance with the legislation, and are not barred from acting by virtue of article 12 or 13 of the Order (e.g. as a result of inadequate performance). Article 3 of the Order prescribes those persons or bodies which have the power to approve individuals to undertake lay representation. These are: Organisations with a current entry on the register of advice organisations established and maintained by the Scottish Legal Aid Board; Organisations which have been awarded accreditation at Type III level against the Scottish National Standards for Information and Advice Providers; Local Authorities; and Citizens advice bureaux which are full members of the Scottish Association of Citizens Advice Bureaux - Citizens Advice Scotland. 21. To ensure consistency and high standards, however, it is recommended that all prescribed persons or bodies pay close attention to the Scottish National Standards for Information and Advice Providers, when approving individuals as lay representatives. Scottish National Standards for Information and Advice Providers 22. The Scottish National Standards for Information and Advice Providers (hereafter referred to as 'the Standards') were compiled by the Scottish Government with the assistance of advice providers in the voluntary and statutory sectors. 23. The Standards are a framework for the development of effective and efficient services and were compiled in recognition of the fact that people choose to access information and advice from various s sources. 24. The Standards framework can be used by any advice provider to improve the quality of its advice service. The standards can be found here: http://www.scotland.gov.uk/Publications/2009/10/05112820/02 25. The Standards distinguish between three principal types of advice giving and intervention. These are: Type I - Active information, sign-posting and explanation; Type II - Casework; and Type III - Advocacy, representation and mediation at court or tribunal level. 26. There is a more detailed explanation of the Types given in the Standards manual. 27. The Scottish Government specifically directs prescribed bodies to certain standards within the Scottish National Standards for Information and Advice Providers for the purpose of this guidance, both in respect of organisational standards as well as those which relate to competencies of individuals. Procedure for approval of lay representatives 28. An individual wishing to act as a lay representative will require to make an application to the approving organisation. A person will not be able to make an application to an approving organisation if they have made an application to another organisation which has yet to be determined. 29. The consideration of an application by the approving organisations must have regard to the interests of persons who might seek to be represented by an approved lay representative. 30. The approving organisation's consideration of an application must also involve an assessment of the applicant's: (a) Knowledge and understanding of: (i)) Scottish legislation and common law in so far as they relate to housing and repossession and (ii) Court procedures and rules, specifically in relation to summary applications in the Sheriff Court (b) Competence at constructing and stating a case both orally and in writing © Advocacy skills, in particular in support and representation 31. The key competences that approved organisations will wish to take into account when assessing an individual's suitability for the role of lay representative are set out in more detail in paragraphs 42-51 below. The approving organisation must also obtain an undertaking that the applicant if approved to act as a lay representative will not act as a lay representative in any situation where this would place the applicant in a situation of conflict of interest, and that the applicant will respect client confidentiality. Training requirements 32. As part of the approval process, the approving organisation may provide an applicant with training in order to assist the lay representative to achieve a satisfactory level of knowledge, understanding, competence and skill in the areas outlined in paragraph 30. 33. Moreover, depending on the competency levels of the applicant, the organisation may need to consider an individual's training needs and arrange or provide training before being able to grant approval. Management and monitoring the performance of approved lay representatives 34. Prescribed persons or bodies have the responsibility of approving lay representatives and it is important that they have systems in place which also set out their own criteria for such approval of individuals. Furthermore such persons or bodies should also have organisational arrangements in place for managing the activity as part of their services. 35. It is recommended that prescribed persons or bodies, whether accredited or not, observe the organisational standards in Section 1 from page 9 of the Standards 3. Close attention should be paid to standards 2.1 - 2.6 4 and 4.1 - 4.7 5 in Section 1 of the Standards, with particular regard to delivering a Type III service on mortgage repossession work. 36. It is advisable that prescribed bodies develop an action plan showing how they intend to manage and deliver the particular elements of service delivery that will be carried out under the lay representation provisions. The organisation will need to be able to relate information about competence, training and supervision of staff to the specific category of circumstance that work will be carried out in. 37. The prescribed persons or bodies should put in place a system for monitoring the performance of individuals approved as lay representatives, paying particular attention to any complaints or concerns about their performance as lay representatives raised by Sheriffs, other court staff or clients, investigating any such complaints thoroughly (see paragraph 59). 38. Prescribed persons or bodies should ensure that approved lay representatives are clear about the extent to which they can and should be acting in any specific case or circumstance. They should be familiar with the financial eligibility requirements of legal aid and remind a debtor where appropriate that they may be able to employ a solicitor through legal aid funding. Lay representatives should also be clear about the point at which they are not competent to deal with a specific case or a particular aspect or legal process, and should refer cases where appropriate to a solicitor who is skilled and knowledgeable in this area, or to another lay representative with the relevant skills and knowledge either in their organisation or another advice agency. Standard 4.3 6 in Section 1 of the Standards, refers to referral arrangements. It is recommended that approved bodies, whether accredited or not, adopt arrangements such as are envisaged by this standard. 39. It is recommended that those persons or bodies with the power to approve lay representatives maintain a definitive list of individuals whom they have approved as lay representatives and review appropriately their performance in this capacity. The approval of each representative must specify the sheriff court districts in which they are expected to act, and it is recommended that the list include that information. This does not limit the number of sheriff court districts in which a lay representative can act but it will be for the approving organisation or body to specify these districts as part of the approval process. 40. It is important that prescribed persons or bodies ensure approved lay representatives are consistently meeting the standards recommended within this guidance. 41. If an individual is not meeting these standards, the prescribed person or body should ensure the individual receives training to improve their performance and should suspend the individual's approval until the person or body is satisfied that they are competent to resume acting as a lay representative. If the person or body remains unsatisfied, they must withdraw their approval. Individual competencies relevant for approval as lay representation 42. It is recommended that in approving lay representatives, prescribed persons or bodies should consider whether individuals are capable of meeting the generic competences for advisers, within the Section 2 Competences for Advisers and Agencies of the Standards. 7 43. Prescribed persons or bodies should note that the competences required for accreditation to Type III - Advocacy, Representation and Mediation level will be particularly relevant for work lay representation . 44. Prescribed persons or bodies should consider whether an individual meets the housing specific knowledge competence for Mortgages/Secured Loans in Section 2 of the Standards. 45. The following key recommended competences are relevant to specific activity that will be undertaken in the court setting. These should be considered in addition to the competences set out within the National Standards, where such competences are not explicitly mentioned in the Standards. Key Recommended Competences of a Lay Representative 46. The key competencies which it is recommended an individual should hold before a prescribed body approves them to act as a lay representative are detailed below. 47. These competencies are considered to be particularly relevant and important when judging the suitability of individuals for the role of lay representative. 48. Has impact and credibility as a representative because: has a good knowledge of subject area, particularly mortgage arrears and repossession procedures used by lenders, FSA regulations and good practice relating to the treatment of customers in arrears, including MCOB 13 8, and consumer credit legislation, and in particular relevant Scottish legislation such as the Heritable Securities (Scotland) Act 1894, the Conveyancing and Feudal Reform (Scotland) Act 1970 and the Home Owner and Debtor Protection (Scotland) Act 2010, and the Applications by Creditors (Pre-Action Requirements) (Scotland) Order 2010. has an ability to make links where appropriate with other relevant areas of law retains objectivity has a good understanding of relevant evidence and presents the above in a structured, coherent and persuasive manner both in writing and orally 49. Undertakes legal research effectively researching relevant legislation, common law and case law, government, regulatory and industry guidance and Codes of Practice, policy statements, etc Understanding the importance of collecting and preserving evidence Discussing all options and their consequences with clients objectively and clearly 50. Understands relevant Court rules, protocols and procedures and basic principles of rules and evidence (e.g. hearsay) understands Sheriff Court procedures and possession procedures, including relevant court notices, application procedures and forms understands the procedure involved in conducting a proof understands the role of officers of the court - i.e. sheriff clerks and appropriate behaviour in court, including the importance of not wasting court time with irrelevant, frivolous or theatrical interventions 51. Use their knowledge, understanding and research to identify arguments, defences and remedial strategies in arrears and repossession actions and present these in a clear manner Identifies arguments which support the client's defence and advise on court orders which it may be appropriate to seek Presents these arguments in a structured, coherent and persuasive manner both in writing and orally Understands post-possession order procedures Challenges negative decisions, actions or legal interpretation which may be adverse to clients Demonstrates an ability to 'think on their feet' in a Court/litigation environment Is prepared to pursue a case to a conclusion where competent to do so and where the client wishes to do so, while at all times clearly explaining the consequences of any action to clients, and seeking to negotiate constructive solutions and arrangements with lenders, court staff or other interested parties where feasible. Withdrawal of approval of lay representatives 52. An approving organisation may withdraw any approval it has granted by providing notice to the approved lay representative. 53. The procedure for withdrawal of approval must involve an evaluation by the approving organisation of the approved lay representative's performance, in particular whether the approved lay representative: no longer satisfies the criteria set out in the procedure for approval is performing inadequately and the approving organisation considers that the approved lay representative's performance could not be sufficiently improved by additional support or training; or has acted dishonestly, in breach of client confidentiality, or in a situation of conflict of interest. 54. Where an approved lay representative has been provided with additional support or training and following a further evaluation the approving organisation considers that the approved lay representative cannot perform adequately, the approving organisation must notify the approved lay representative that the approval is withdrawn. 55. An approval of an approved lay representative is deemed to be withdrawn if the organisation which granted the approval ceases to be an approving organisation. Circumstances in which an approved lay representative may not act 56. An approved lay representative may not represent any debtor or entitled resident other than in proceedings where the debtor or entitled resident is a client of an approving organisation, though not necessarily the organisation that approved the lay representative. 57. Where an approved lay representative is performing inadequately and the approving organisation decides not to withdraw approval; and instead to provide additional support or training to improve the performance of that lay representative, the approved lay representative may not represent any debtor or entitled resident until the approving organisation is satisfied that the approved lay representative can perform adequately. Prescribed persons or bodies to provide Scottish Ministers with information 58. Those persons or bodies with the power to approve lay representatives may be required to provide information to Scottish Ministers about lay representatives. 59. Scottish Ministers will not seek to obtain information on individual lay representatives, but it is anticipated that aggregated and anonymised information will be requested from approved organisations, particularly: total number of individuals approved as lay representatives by that organisation the number of lay representatives approved by that organisation over a specified period (for example during the previous year) the range of Sheriff courts in which these lay representatives operate and the number approved to operate in each Sheriff court details of the training provided to lay representatives by approving organisations over a specified period (for example during the previous year) number of lay representatives that have had approval withdrawn over a specified period (for example during the previous year) and the reasons why approval had to be withdrawn Although not required under the Order, it is hoped that approved organisations will nevertheless co-operate, wherever possible, with any other information requests that Scottish Ministers may make for the purpose of monitoring and evaluation, or arranging additional training, awareness raising or other support to ensure an effective lay representation service is available everywhere. For example information might be sought about: the approximate number of cases in which they have provided lay representation for repossession cases the sort of feedback approved organisations have received about client satisfaction levels when they have offered a lay representation service any issues or difficulties (beyond any need to withdraw approval of individual lay representatives) which have arisen in providing a lay representation service, for example an indication of the approximate number of times when they may have had to turn down requests for lay representation and the reasons for having to do so Indemnity Insurance 60. Persons or Bodies with the power to approve lay representatives are strongly recommended to consider the liability of those individuals that they approve, and indeed the liability of the body for the actions of individuals approved by it. Prescribed bodies should refer to Standard 3.9 and 3.11 9 in Section 1 of the Standards and consider their position. They are strongly encouraged to ensure that they have appropriate Indemnity insurance. Complaints procedures 61. Those bodies with the power to approve lay representatives should ensure that they have a complaints procedure in place, for individuals receiving lay representation to use if any problems arise during the process, and that any complaints are investigated thoroughly. (See paragraph 36 above and Standard 3.11 in Section 1 of the Standards) 62. As part of ongoing work to ensure that approved lay representatives are continuing to act at high standards, prescribed persons or bodies should seek regular feedback from users and stakeholders, such as court staff and Sheriffs. (See Standard 3.12 in Section 1 of the Standards) Housing Access and Support Division Scottish Government Yes, its alot of reading. I am doing alot of reading to fight my bank. i am going to represent myself to contest the calling up notice if my bank decide to go down the road issuing me with a calling up notice. The bank's solicitors keep making threats to take me to court (3 letters so far), and Up to now they have not given me clear breakdown of the debt. Just demand the total amount from the 3 accounts that i have with the bank.

3053548.thumb.jpg.6ea05a752ac6bbf38ae4e7be9676053a.jpg)