Search the Community

Showing results for tags '@mbna'.

-

Hi, Sent a CCA request to MBNA who i have been paying on a DMP with Stepchange 10 days ago, have just found my original welcome letter and it is with Bank Of America / Amazon. I have not had a reply as yet. Account opened in 2012. Wondering if i should have sent the request to BOA rather than MBNA Cheers

-

Hi, Im trying to unravel my late father's very complicated finances, as I'm his executor. I found a letter from Hoist Finance dated from last year stating they own the account, with an outstanding balance of £2131.92. When I phoned to say he'd died they told me it would be passed to 'Philips and Cohen' - this was mid-January and I've heard nothing (luckily). Having read these forums I then wrote to MBNA requesting all his account data but they replied stating the 'GDPR only applies to personal data relating to a living individual'. is this true?There's also a letter relating to another MBNA debt from Link Financial, so they have sold the two on. I need to know how old these are etc. Letters scanned and attached. The reason I'm confused is I've also written to Santander (using the same template letter) and have received all the loan info so they obviously have different rules! - I'm not willing to settle anything unless I know how old these debts are and what they relate to. We couldn't find any paperwork at my Father's house. Any advice as what to do next - I did send certified copy of probate certificate with my requests. Many thanks for reading! scan0041.pdf scan0040.pdf

-

Hi There, Been playing games with MBNA for months now on CCA etc and they passed onto PRA Group to chase, they have come back now and said the application was done digitally! Not sure where I stand now or what I can do? Thank you in advance for your help. Regards Steve H

- 1 reply

-

- application

- digital

- (and 4 more)

-

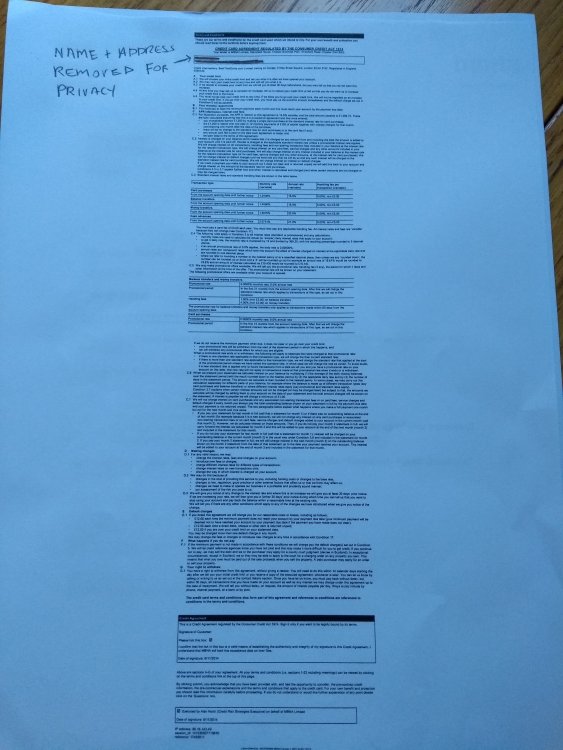

Had the following back from MBNA in response to a CCA request. 2 sets of T&C's, one current, and one supposedly from the time they card was taken out (not sure how I'd actually verify that) A summary statement showing current balance And a "copy executed agreement" Have uploaded the covering letter and the redacted "copy executed agreement". Basically, is this valid? This card was taken out in late 2014, and from what I've read it seems like it probably is a valid an enforceable response to my request, but would like to be sure before taking next step (MBNA bluntly rejected a recent full and final offer of around 60% of balance, claiming they never accept such offers. I should also mention that the debt is still with MBNA and no payments have been made for 3 months now. Current balance is a around £10.5k. Borrowing from family and selling a few things I reckon I could raise £8k tops. It doesn't seem like MBNA would accept this as a full and final, and all the while the interest mounts up.

-

Hi, my balance was £6,700 on my MBNA credit card and paid £4,409 which made my new balance £2,224 owed. My direct debit then paid the minimum of £67 which should of then made my newer balance £2,157 but this did not happen, instead, my balance owed went from £2,224 to £2,291, adding £67 to the debt rather than deducting it. I'm currently in a interest free offer and I have not used my card. This has never happened before, it's strange.

-

Hi there, I am trying to help my mother reclaim PPI she paid some years ago, she sent in the complaint forms in december..she quite quickly received a letter responding just to say her complaint was received and they will look into it. on the 3rd jan 2014 she received a letter it said this.. "Dear mrs **** Please accept my apologies for the delay in responding to you; however, our investigations are taking longer than anticipated. We will issue a response by 3/2/14" Then today this letter... Latter dated 20/jan/2014 "dear mrs **** Thank you for contacting us in relation to your complaint. I would appreciate it if you could please contact us within the next 7 days on ******** (phone number), this will allow us to progress your complaint If we do not hear from you in the next 7 days, we may provide you with a final response based on our findings from the information we hold Yours sincerely Tristen lynes" What i would like to ask is Should she phone back? Does she have the rights to phone them simply to acknowledge the letter but ask that all communications are done via letters so she has evidence and can build her case? or would it be better to send a letter first class recorded asking for all correspondence to be kept to letters not the phone?. does she HAVE to speak to them on the phone? Any advice would be appreciated:)

-

I have read other posts, but have difficulty following since my brain shrunk! I am just about 69.= Old! I thought it best to start my own thread. I had an arrangement with MBNA, Who accepted token payments for a few months, following help and advice from CCCS. Wife and I do have other creditors, All have ripped us off in the past with Mis-sold PPI, both S/E, Had they not done so, we would not be in the position we are now! I am trying to get into claiming these back, but it seems that before I get into that, I have to defend us against the likes of Moorcroft, and now Arden, my first question is, should I answer the phone to Arden? Am I right in thinking I do not have to make a contract with Arden? I have continued paying token payments to MBNA, They have not asked me to stop! I have had much treatment for Stress and mental heath problems caused by Banks and Debts. Any advice to start me off gratefully received. Regards Ro

-

hi lovely people i sent a CCa request on 21/04/14 to Lowells for MBNA old debt from 2005, i have been paying token payments since 2005. i havent had a reply back to CCA request and have recieved a letter from Hamptons legal re-payment options. i have suspended payments since, but while going through the paperwork, i have noticed the a/c number on all their correspondence over the years does not match the account number in question. should i querry this with them?

-

Hi all, I have had many issues with MBNA, but most have been resolved in my favour. However this one is proving a little more difficult to deal with. I had an MBNA credit card from 1999 to 2003 all was ok until I was signed of sick, I continued to pay MBNA while i was off sick for the first year as i get paid for this and then I tried to activate the PPI that they sold me. I was told that because they didn't see clinical depression as a reason they would not activate the PPI (I have successfully claimed the PPI back). My problem is after I informed them of the financial hardship (ie not getting paid anymore other than SSP) they then added £2800ish in charges and fees which wouldn't have occurred had they not of missold me PPI (they have admitted this already). They would not freeze interest or charges and added all this interest and charges in the 6 months before they sent it to debt collection agents. (I have all the charges and already obtained a SAR and sent the charges sheet into them with the first letter). I lodged a formal complaint with them as soon as they upheld my PPI claim and they have responded stating they will not repay charges as they have no record of me trying to activate the PPI. they upheld my PPI claim on the basis that due to them not activating it for newly diagnosed clinical depression i had been missold it. Can someone give me some advice, on where to go next. How can MBNA state they never had a record of me trying to activate the PPI when they paid a misselling PPI claim solely on this basis. Do i have a good chance of reclaiming the penalty fees they issued after I tried to activate their missold PPI? (please note that this has been fully paid now including all charges and interest) I am happy to issue through court if this is the route to go. Thanks in advance L

-

Hello Forum I apologise in advance if this is answered somewhere else but I cannot find it. My ex-wife had a credit card with MBNA and amassed debts of £4700 on it. This was 7 years ago and I have only found out today that she is still paying this debt off. She is paying the minimum monthly payment which would appear to be mainly interest therefore she is never managing to reduce the amount. Today for instance her latest statement stands as follows: Balance from Previous Statement: £3411.06 Payment Received: £120.41 Cr Interest Charged: £89.02 New Balance: £3379.67 Estimated Interest Next Statement: £77.31 I have no idea as to how to work out just how much interest is being charged but to me it seems that she is never going to be able to pay this off and as she is now a pensioner, I envisage her getting more and more depressed over this. I would appreciate any advice you may be able to offer in how to perhaps approach MBNA to see if things could be improved.

-

Hi, Had 2 letters from these guys in the space of 2 days. Say I owe Caboot 1400 for a credit card from MBNA. Now, I had one of these in 2001 when I was young and stupid but far as I know my parents paid it off at the time. If not there could have been no more than 300 as that was my limit. Any ideas? I'm not paying these clowns.

-

Hi All I'm in the process of dealing with an account of my wifes and I was told by the operative at MBNA, when asked for statements going back for the past six years as I intend to claim all the charges back, that they only keep records back to 2005. I would be gratefull for some advice here on how I should proceed. All the best Mike

-

Hi all, my first post here, hope all are well. Am seeking some educated advice and from my reading of other threads this looks like the place to ask I hope. So the background... I used to have several cards/loans that I ran up and couldnt pay (yep fool i know but that was a while ago now, single, out every weekend etc) summing almost £15k I ended up with CCCS and cleared much of it. I then came into some money with which I got settlement figures from 4 creditors & used all the money and paid them.. .MBNA would not give me a settlement figure & by this time I was out of the DMP with CCCS as I only had MBNA left. This was summer 2010. After requesting settlements & hearing nothing, I sent about £50 a month and was passed to Mortlake Recoveries in Jan this year. I had the card initially from around 2005. It was around £4200 in 2008 and is now at £2400. I missed a payment to Mortlake in April by mistake which I explained to them was due to stress at home ( our son has autism) and then I caught up in May but in June they have passed me on to Arden CM. I have set up a standing order to them of £50 a month... the first one was paid 1/7/12... they keep writing saying Im ignoring them and havent made an attempt to deal with the matter... they call 8 times a day. ..I ignore them as I only contact in writing.. .however they only seem to receive "signed for" letters...surprise. I rang them today and was told that I need to make an official arrangement with them for repayment over the phone and I cant just send money every month.. .I thought this was odd-they either want the money or they dont surely. He also said I need to do a I&E over the phone...I said Id ring back. Am I correct in saying. ..an I&E is not compulsory & my I&E is private unless a result of a court hearing and then only known to the judge? Should I write & tell them they have no right to know this? Should I also send them the request for the CCA and stop the standing order? Also Im seeking info on the "no phone calls or doorstep visit" letters as they are threatening that now. Hope my waffle makes sense thanks for your time guys Paul

-

Hi I hope somebody can help me. I have a debt of c £2,700 which I presume Link bought from MBNA. I have been paying £15 per month for over 10 years and they have now all of a sudden started telephoning me. I dont know how they have my number as it is ex directory and in a different name to the debt. I no longer work and am disabled and really cannot afford the £15 but keep paying just to try to pay the debt off. I owe over £30k in total as I had to give up work due to ill health and I have two very small children also. I have MS and this is making me ill with worry. Please can somebody help and give me some advice. I have sent the letter asking them to confirm that they own the debt but I am now frightened to answer the phone in case its them. Help help help please. Thank you Charlie Do you think I would be better declaring bankruptcy?

- 15 replies

-

Oh dear Experto have sold O.Hs alledged account onto Aktiv Capitol;

-

Hi I have found CC statements dating back as far as 1997 with MBNA, there is PPI on these statements. Do you think I have any chance of getting this back as I believe it was missold at the time due to my circumstances? I think I cancelled the card in either 2002/3. Therefore the account is no longer active. Not sure how to get the ball rolling if I do decide to proceed so any assistance/guidance on this matter would be really appreciated.

-

MBNA I'm in the middle of a PPI claim (have been self-employed since 1995 but discovered I've been paying PPI on my credit card since I took out the card in 2003). Today, I had the most annoying letter, from MBNA, saying the following: 'You may recall that we recently wrote to you and requested that you complete and return a questionnaire to provide further information in relation to your PPI complaint. To date we have not received your questionnaire. I have completed a review of the account based on the information we currently hold and am unable to uphold your complaint or issue a refund on the premiums you paid. This is our final response to your complaint. If you remain dissatisfied you now have the right to refer your complaint to the Financial Ombudsman, which you must do within 6 months o the date of this letter. For more information about how to do this, please read the enclose Financial Ombudsman's leaflet. Their address is as follow: [FO address] Yours sincerely Rachel Nixon' This letter is astonishing and annoying as: 1) There is no telephone number to call them up about this letter. 2) In early-Jan, I started a PPI complaint against MNBA. I called them for some basic info and said I'd send them a filled out copy of a PPI form (which I found online via a BBC site). They said not to bother as they would fill one out for me. The inference was that this was a 'service', that they would speed up proceedings as they had all the facts and figures to hand. Stupidly, I trusted them. I actually waited around 10 days for the form to appear and all that was on it was my name and surname. No other data. So they had simply slowed the process down by ten days. 3) With the form was a letter, demanding that I fill out the form within 21 days, or the matter would be closed. I don't ever recall entering into a contract with MBNA saying I had to jump to their timetable. This was especially rich as they had wasted 10 days - and had, in fact, sent a follow-up letter, apologising for *their* delay in sending out necessary information. When the apology came, I assumed something else would be arriving in the post from them - it didn't. 4) As I was busy with work at the end of Jan, it wasn't until around the 20-day mark that I was able to get down to the form. I actually called them, first of all, for some data (the start date of my credit card contract). At that point, they had every opportunity to say the case was closed, due to some strange time limit they'd imposed without my permission. They did not. 5) I spent the best part of a working day looking through the questions on the form, then posted it to them. 6) On 23 January, I received the above letter, dated 15 January (when did post ever take that long to arrive?). ...I have never, in my life, come across what feels like such a blatant attempt to renege on responsibilities. This, coupled with a lack of reply address, gives me an even lower opinion of MBNA and their insurance companies. Am I within my rights to go back to them? I don't want to go to the FOS - I'm a busy person and would like a speedy resolution to this matter (I estimate MBNA owe me within the region of £4000. However, if there is no other option but to go to the FOS, is there anything I can say to the FOS about these frankly dodgy practices? Brenda

-

Brief history … MBNA credit card into difficulty due to self employed and debt sold to Link Financial who took me to court and won and was ordered to pay full amount but I then applied for Variation order and was awarded to pay £10 per month . But Link did apply for a charging order and was awarded. Now since my CCJ I have paid the £10 by postal order and also sent every payment by recorded delivery to the address on the CCJ. After about the 2nd payment I started getting the standard letter saying I had fail to pay as per the CCJ etc and also constant barrage by phone but talking to these plebs is like talking to a brick wall and informed I had sent and had proof of delivery. However after a lot of arguing it transpired the address on the CCJ was the Caerphilly office and they are not set up to take payment ????? I asked they send me a letter instructing me to make payment to another address other than as stated on the CCJ. I also send them a letter demanding that as of now all correspondence had to be in writing and to stop calling both my land line and my mobile. I also sent them both copy of the postal order and proof of delivery slip and eventually I received an apologetic letter telling me they would cease to call and all correspondence would now be by letter. Now today I received a statement from Link and find that a charge of £72.00 under AGT (whatever that is) and £264.00 under CAT (whatever that is ) has been added to my account. Now my query is what the hell are these charges … and are they not bound by some sort of governing body to make sure you know what the hell is being added … and why are they added. I have proof (as I have already given when they requested ) that all payment where received by recorded delivery before the date. I have sent both a copy of the recent statement and a copy of the Final Response they sent to me telling me that had made a complete balls up lol. Oh and before anybody asks … . Yes there is PPI going back to when I opened the cerdit card in 2003 lol… . About 5 weeks ago I found some old statements in the attic going back to when I first opened account (self employed ) and showing PPI and received the SAR I sent last week so need to sort that out soon as I sort these clowns out and I will create a separate thread for the PPI battle lol.. If there is PPI does it make the Link CCJ legal and also the Charging order. Is there any point in complaining to who ever they are governed by and can I now start charging Link for the constant harassment and bad management that means I have to spend a lot of time dealing with this issue. Any help would be appreciated

-

Hi guys I have a letter from MBNA saying a/c is sold to above trading as Idem services and also enclosed a letter from Idem services which strangely says ‘…there is no current requirement for you to amend your details as we have arranged for your payments to be redirected to us from MBNA.’; but they do kindly provide their bank details should I choose to pay them direct and they’ve kindly provided a shiny new a/c number for me. I was making token payments with MBNA with interest and charges frozen. I see from our forums that Idem is part of Paragon but their letter says they’re a trading style of Idem Capital Securities Ltd which in turn is an appointed representative of Mortgage Trust Services PLC (I suppose it helps explain who you are when caught shagging someone who was not your contractual partner). I guess that this is a move towards a CCJ and charging order which does not bother me greatly as equity is zero or near zero. I also guess that they’ll attempt to take the p*ss with penal charges before going for the CCJ and that, despite appearances to the contrary, things are not as they seem in that MBNA appear to be happily acting as their collecting agents. (As an aside, I see that the bearded one is exercising rights to buy the V bit of MBNA Europe and that Barclay’s offer for the bigger bit has been rejected as being too low – at this rate Barclays will be doing our funerals next). Anyway, I am pondering on plan which is centred on the provisions of the EU credit directive and holding the new boys accountable for everything; meanwhile have any fellow CAGers had one of these NOAs? x v

-

Hi all, I'm about to start a reclaim of credit card charges from an old defuct MBNA account. I've already sent a SAR request for copy statements etc and received these back, and I'm currently preparing a SOC. There are 19 charges for late payments/over limits ranging from £25 - £12 from between 2004 and 2007, totalling just under £500. I've had a good read through the forums for tips and advice, but I could do with some help to the following questions as some things seem to be contradicting themselves in different threads: 1) When calculating the APR, do you use the purchase or cash rate? According to the statements, i've had up to 4 different rates at any one time due to various promotional rates, so choosing the right one is proving tricky. 2) Do you use the APR at the time of the charge, or the final APR from your final statement/ closure of account? 3) Is it wise to go for full restitution through the courts, or just simple interest throgh the FOS? 4) Do you claim compound interest from the date of the charge to the present day, or only for when the account was in debit, and then simple interest when in credit? 5) Do the FOS deal with non PPI complaints faster, or does everything go in one queue? This account was charged off in 2008, and sold to a DCA. Unluckily for them, they bought a turkey as there was no valid agreement or original t's and c's. When I challenged them, they put the account on hold and then later confirmed to me in writing that they would not be persuing the account any further. RESULT!!! These charges are the final piece of the jigsaw with this account and then it can be finished with for good. Thanks in advance for any replies.

-

Last month I sent a SOC and a claim to MBNA regarding the "unlawful" charges applied to my CC account between 2001 and 2006. I was charged a total of £1313 for late payments and going over my credit limit. After applying CI at 24.9% the total comes to over £6000. Had a letter from MBNA this morning stating that they did not agree with OFT's interpretation of the law and that they were offering £200 as a goodwill gesture and to take it or leave it. Any suggestions what my next action should be? Thanks suvin

-

I have been in dialogue with MBNA since late last year regarding PPI. I never asked for it, but they claim I did via telephone. I have asked for dates, and times, and they just reply saying 'by telephone', and then said they would not respond any more. I have asked for a copy of the CCA, and not received it. I have told them I dispute the debt then, as the payments are calculated with insurance. In 2009, I was laid off, and when I couldn't pay the bill they said why didn't I make a claim under insurance. As I was not aware I had it, I asked how I could, and they said under my policy. I was not aware for 3 months, and was then told I couldn't claim back from the first date of unemployment. So I got some money - not much, but I was not aware I had it, or paying for it. I have asked for it to be stopped, as I am self employed now, and was assured it had been, then last week I received a letter telling me of important changes to my insurance policy ! Using information from other sites, I wrote them 3 letters at 10 day intervals stating they had 10 days in each case to provide the CCA, or a sworn afa davit saying the debt was mine. I told them if they made contact by any other means other than mobile phone they would be liable for charges, and they have emailed me, written to me, but none acknowledging my letters. I have now received a letter from Optima tghreatening legal action if I do not pay the debt in full by 14th April. What should I do ?

-

I have had na MBNA card for more than 15 yrs, for the first time ever 6 months ago I stopped making payment due to financial difficulties, amount currently outstanding is GBP 1,700, I had a phone call from MBNA a few days ago at my work place (I dont know where they got the number from) and they threatened me that if I didnt make a payment of outstanding amounts overdue approx GBP 350, they would sell my debt to a third party, I tried to reason with them, and they asked me what was the minimum payment I could make, I told them nothing at the moment, they then suggested GBP 45 p.m, and that had to be made this month. I have been living in Spain for the last 10 years and have been making payments by bank transfer frm my Spanish bank account. Please advice, thank you

-

Evening peeps, Some months ago (October) i started to look into my MBNA account to see if there were any charges on there (the account was closed last april). To my horror i saw there were £624 of charges on the account, small potatoes but i thought bugger 'em! i used the calculator on http://www.moneysavingexpert.com/reclaim/credit-card-charges to work out my interest, of which it was £111. I requested it back from MBNA and was to where to go, as the charges were fair. I went to the FOS who have just (friday) wrote to say that MBNA will pay £588 plus £110 in interest. SO, im now wondering as they are willing to refund without a fight have i under valued my interest?? AS reading the forums MBNA would prefer to kill kittens on live TV than part with their/our money. hope this makes sense x

-

Hello, I was hoping someone would be able to give me some advise. I opened a MBNA Platinum account last year due to the promised offer of 12 months interest free on all balance transfers for 12 months. With this in mind I transferred my existing Credit card balance to this account and set up a standing order to meet the minimum payments on a monthly basis, however it turns out that the standing order I set up did not take into account the transaction time and did not clear until 3 days after the payment due date. As I only opted for the online statement it was 3 months before I realised this was the case and resolved the matter deciding to let them take a direct debit from account instead of the standing order I had put in place. As a result MBNA say that I have invalidated the t & c's on the 12 month interest free agreement and have charged me interest on the account ever since the first payment was received late. Do I have any legs to stand on to try and reclaim the additional interest I have been charged over a period I original had thought would be interest free? Any advise, guidance or tips would be greatly appreciated.