saddler10

-

Posts

201 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Posts posted by saddler10

-

-

This topic was closed on 10 March 2019.

If you have a problem which is similar to the issues raised in this topic, then please start a new thread and you will get help and support there.

If you would like to post up some information which is relevant to this particular topic then please flag the issue up to the site team and the thread will be reopened.- Consumer Action Group

-

This topic was closed on 03/08/19.

If you have a problem which is similar to the issues raised in this topic, then please start a new thread and you will get help and support there.

If you would like to post up some information which is relevant to this particular topic then please flag the issue up to the site team and the thread will be reopened.- Consumer Action Group

-

Apologies for the lack of updates on this, however since receiving my 'final response from Cabot early last month and my complaint to Consumer Direct I have heard nothing. Hopefully a good thing?

Saddler10

-

Got a reply today from Consumer Direct, my complaint has been passed to Trading Standards.

-

have just sent my complaint to Consumer Direct, will update on any progress...

Saddler10

-

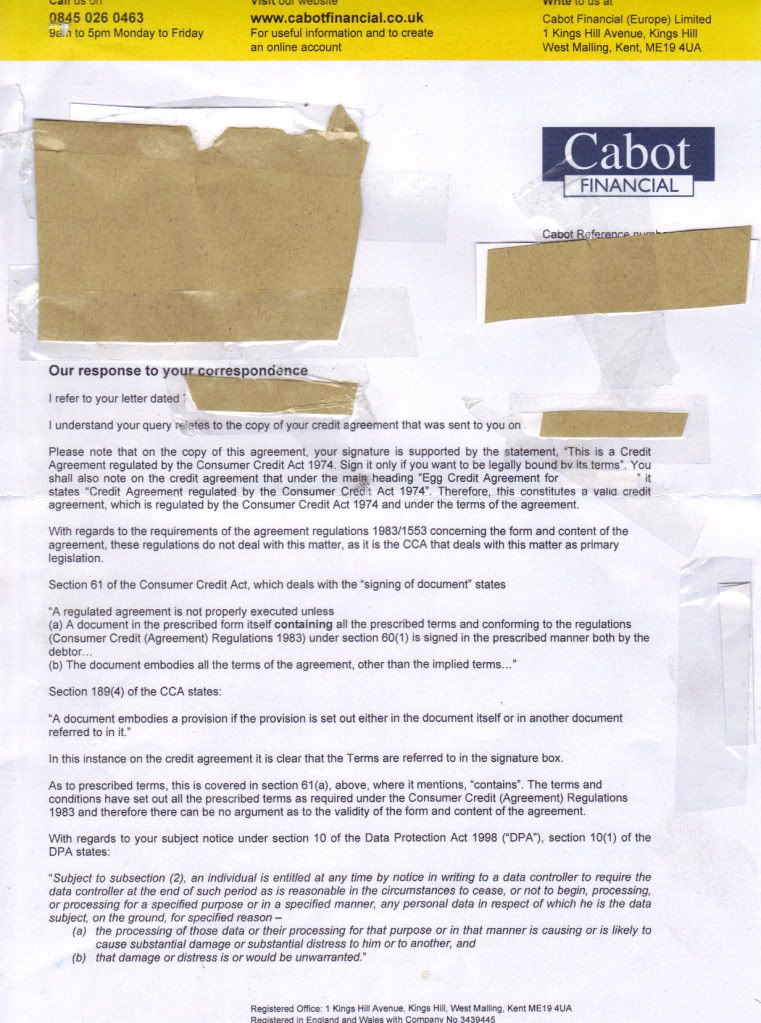

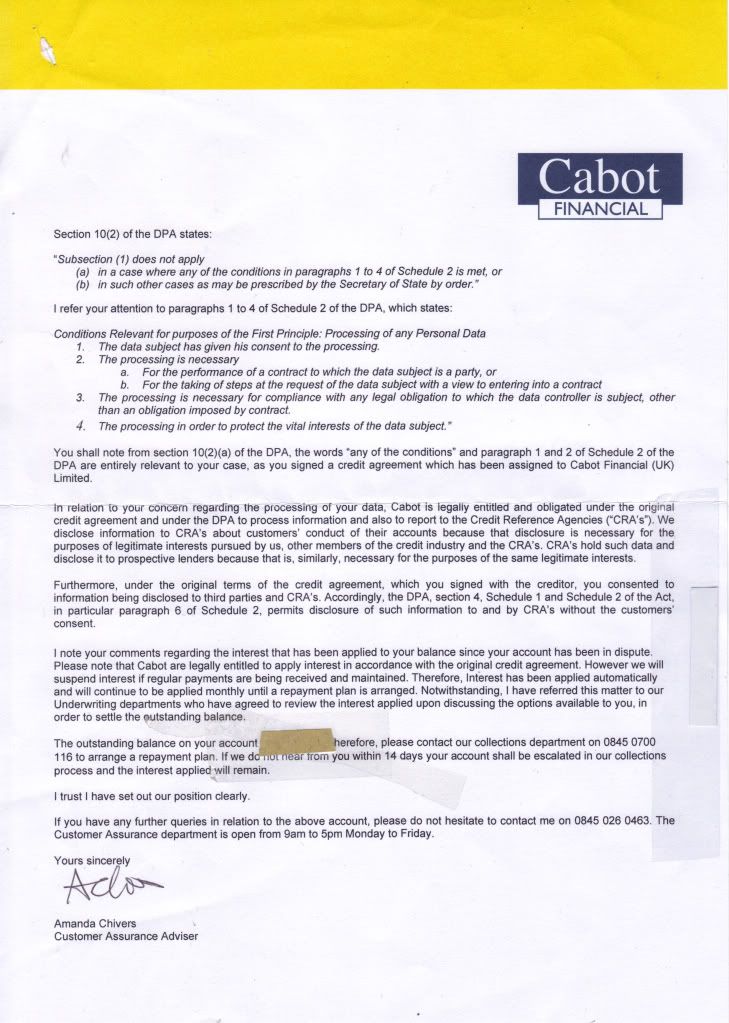

More from Cabot, anyone who would like to tear it apart, feel free, think there are issues with misquoting/selective quoting of cca as discussed here;

-

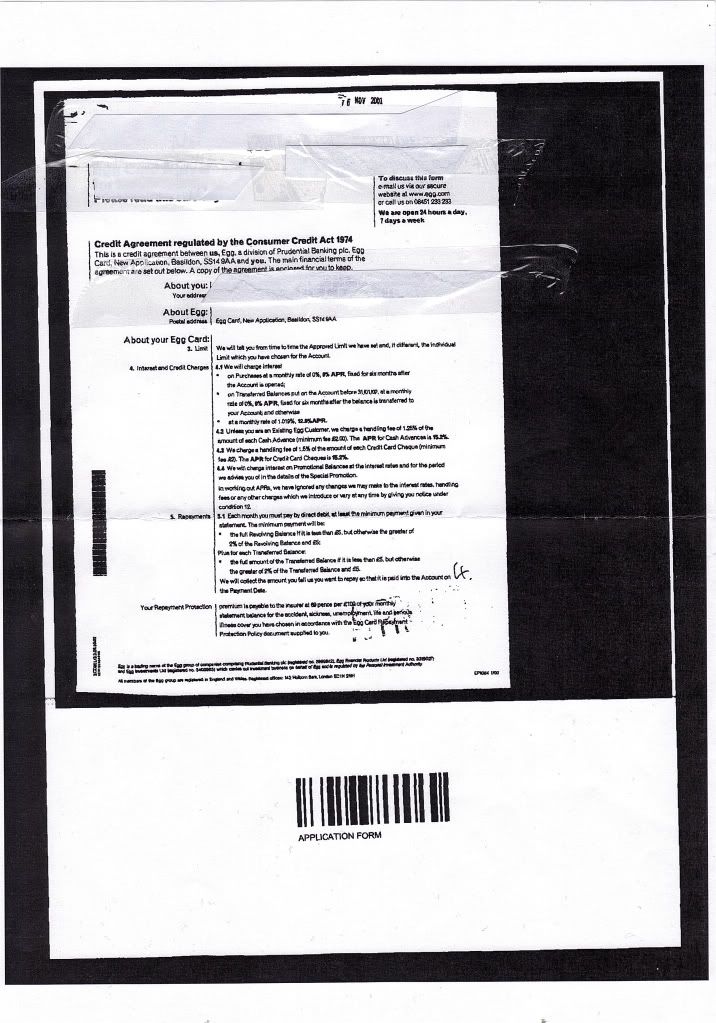

Thanks AC. As far as my CCA request goes, it was made to Egg while the account was being handled by DLC. Eventually, I got a statement of account from DLC but nothing else. When it went to ARC, again I told the DCA that this was unenforcable, eventually ARC provided me with the same statement that I had already received, some kind of generic terms and conditions apparently from the time that I opened my account. They also confirmed to me that Egg could not locate my agreement.

When you say you do not buy the NoA, I can see how dodgy it is and have mentioned it in my complaint to Trading Standards, any other action you would suggest on this?

Saddler10

-

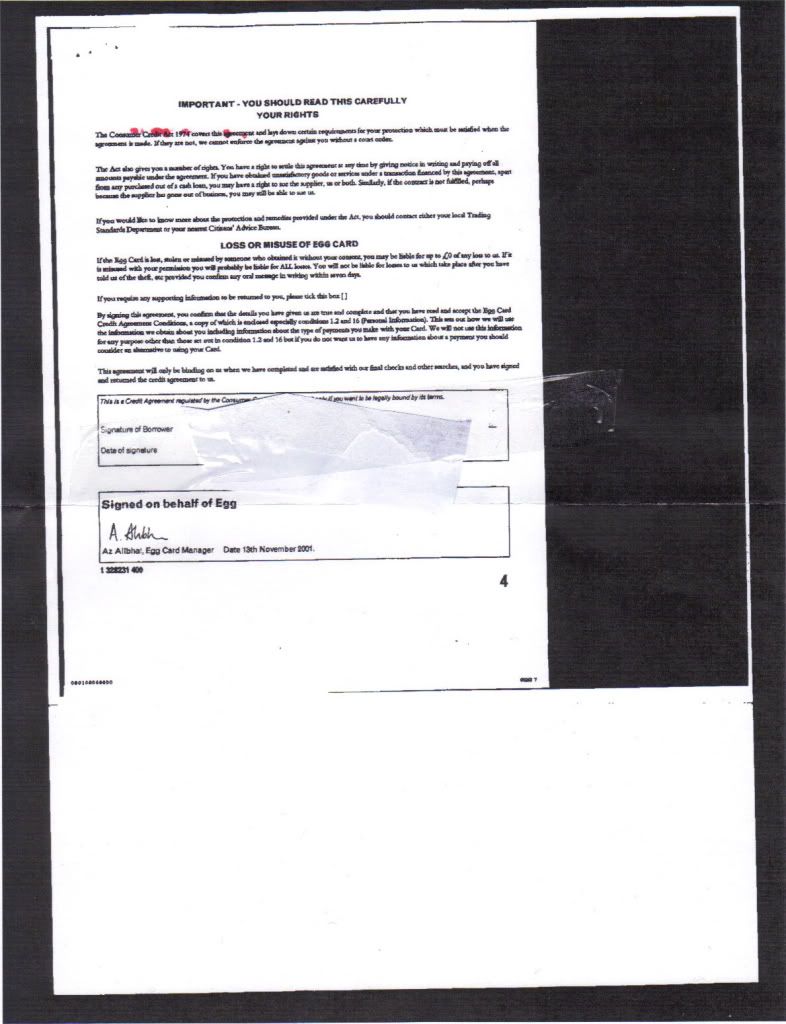

Just to update, after receiving my 'agreement' in June (see post 19), I informed Cabot that the 'agreement' is unenforcable for reasons discussed here;

http://www.consumeractiongroup.co.uk/forum/legal-issues/188093-egg-credit-agreements-what.html

Saddler10

-

Thanks Angry Cat, emailed my local trading standards yesterday. Notice you complained through Consumer Direct and they passed it on to Trading Standards, is this the best way to go?

Saddler10

-

Thanks spamheed, will get my letters back up as soon as I can, properly edited of course!

Saddler10

-

So, after about six months this is the letter and 'agreement' that Cabot sent me, I will try and post the reply I sent them shortly;

-

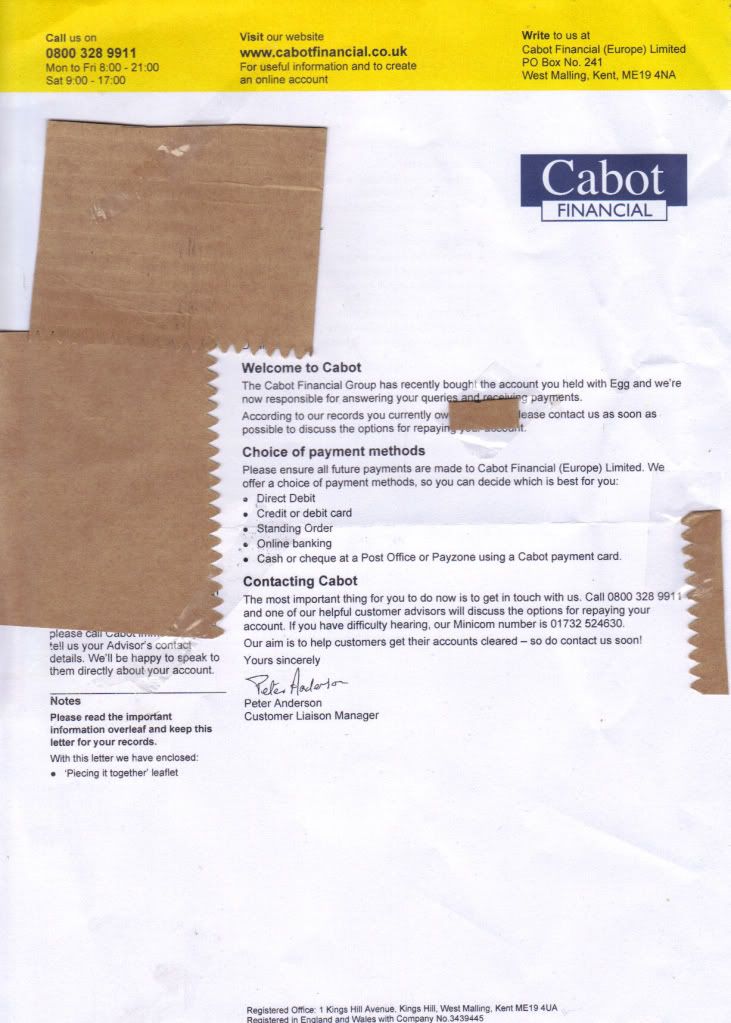

Some interesting stuff here, shame I have to go to work today! Just to try and get things up to date, following Cabot's first contact almost a year ago, I wrote back straight away informing them the account was disputed. They then sent me a letter to say they would contact Egg regarding my 'query'. I wasn't really making a query, I was telling them the account was in dispute.

They said they expected to get a reply from Egg within 21 days but due to archiving could take longer.

I then heard nothing for about six months, when Cabot sent the 'agreement'. I will scan the letter and agreement for my next post.

Saddler10

-

Cabot have sent an 'agreement', which I believe to be unenforcable due to reasons discussed here;

http://www.consumeractiongroup.co.uk/forum/legal-issues/188093-egg-credit-agreements-what.html

However, I don't think an unenforcable agreement will stop Cabot.

Saddler10

-

Hi, I informed Cabot that the account is in dispute, but they are ignoring that and continuing to pursue and add interest.

Saddler10

-

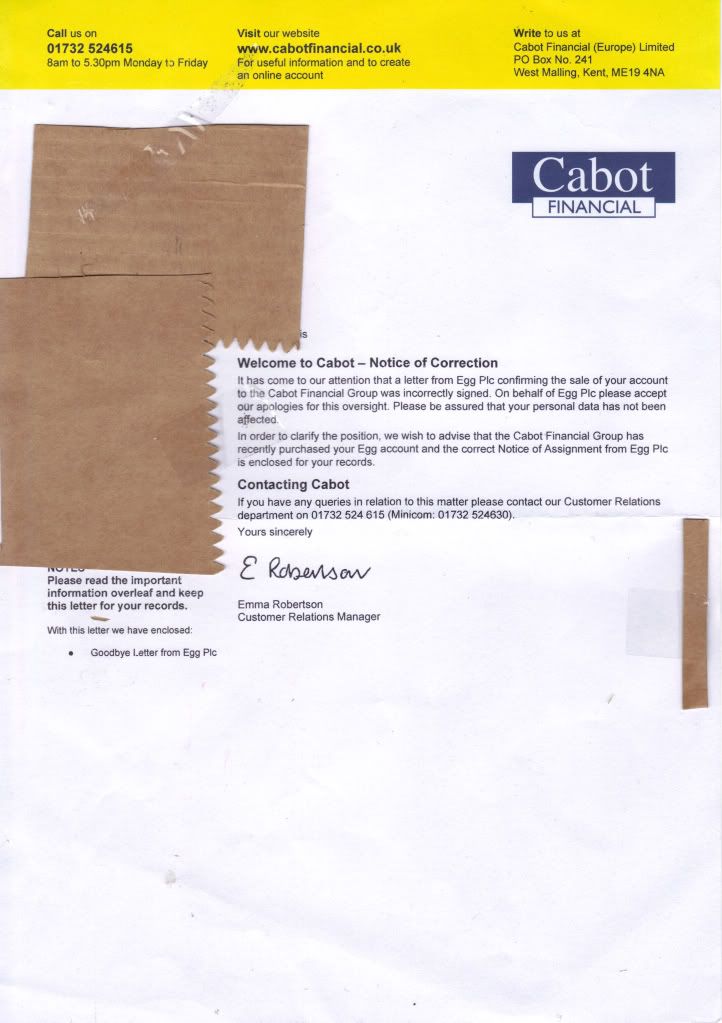

After a couple of weeks I got the following from them;

So, in the notice of correction, Cabot apologise on behalf of Egg PLC. Are they seriously saying that someone at Egg forgot who they work for?

Saddler10

-

Hi balster, I have started a new thread, just so I can focus on the fact that this is now a Cabot issue.

http://www.consumeractiongroup.co.uk/forum/debt-collection-industry/225773-saddler10-cabot-egg.html

cheers, Saddler10

-

Thanks Fred, will try and get the rest of my correspondence up over the next couple of days.

Saddler10

-

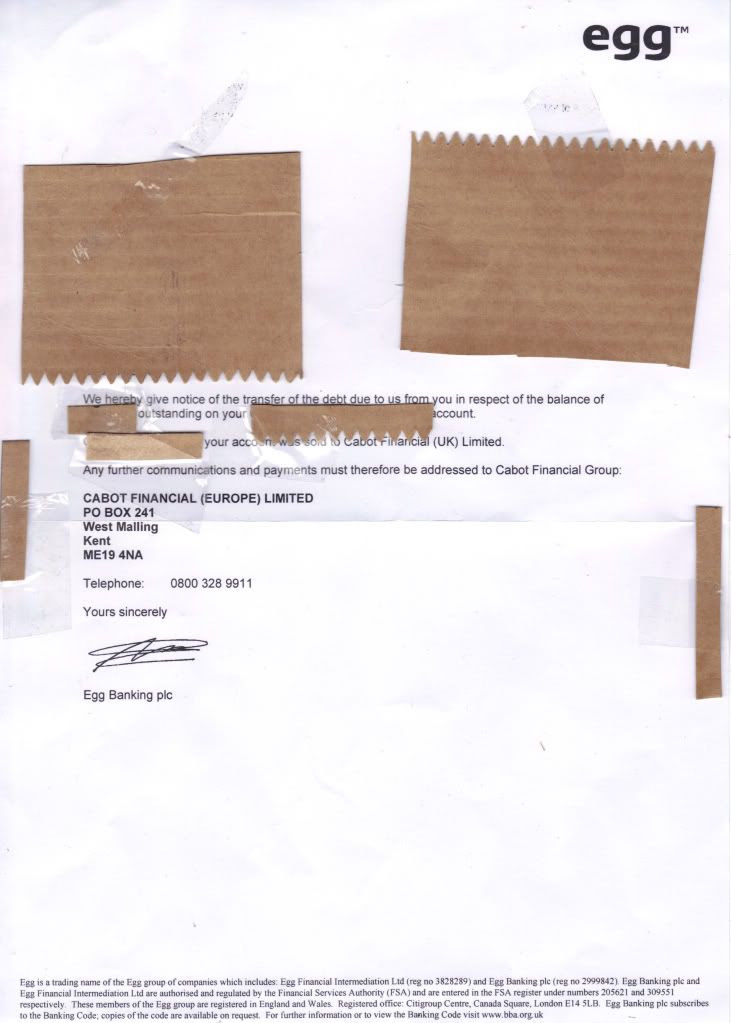

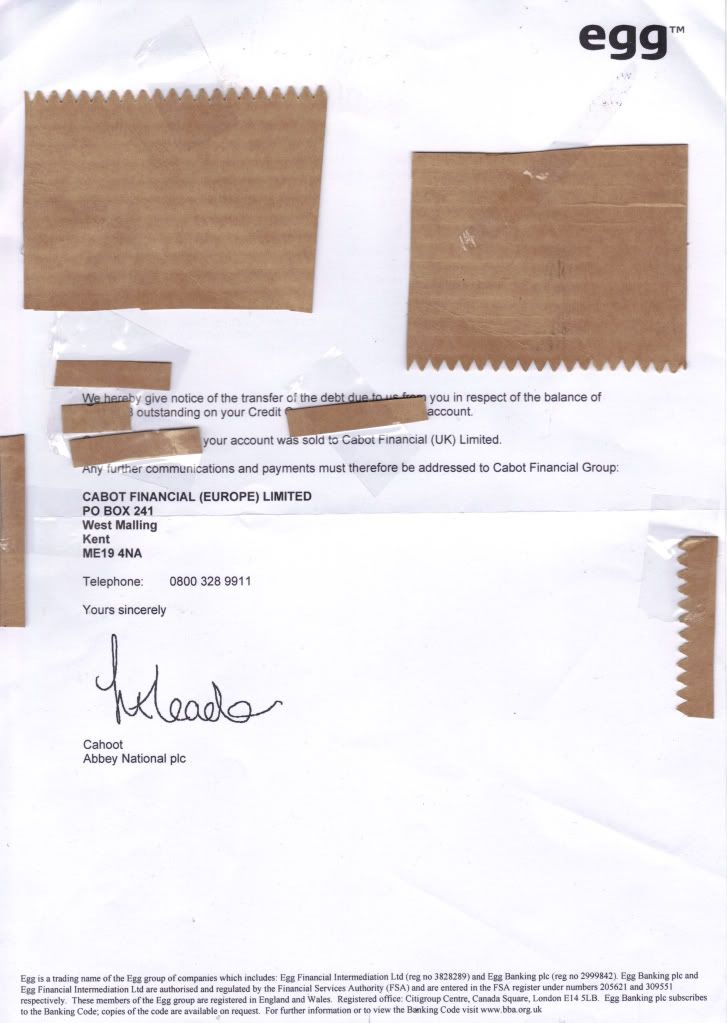

Right, this is my first contact from Cabot from last November. Note at this time I had not been supplied with a credit agreement following my CCA request in 2007.

Also, on the letter enclosed from Egg informing me that the account has been sold on, this on Egg headed paper, is signed by CAHOOT/ABBEY NATIONAL PLC! How could this happen? Cabot sent me a notice of correction shortly after.

-

Hi all, I already have a thread covering this, but now that this account has been sold onto Cabot, and having read a lot on the forums about the way that they behave, I have decided to start a new thread where I can summarise what happened pre-Cabot and where I am now with this. Some of what I have been reading I find very worrying!

I have just received a 'final reponse' from Cabot, basically saying they don't accept my dispute, I will scan and post all of my correspondence from them, but first of all the background...

The first DCA that I had dealings with concerning this account was DLC, they were demanding 2k immediately. At this point, I sent a CCA request to Egg, who couldn't supply the credit agreement within the time limits and the account became unenforcable in August 2007. DLC then passed this to their solicitors, Aplin, but when I wrote to Aplin informing them that the account was in dispute, I didn't hear from them again.

All went quiet for a while, then Egg passed it to another DCA, ARC. Again I informed the DCA that the account was in dispute. ARC then sent me a statement of account and a copy of the terms and conditions as they were when agreement was signed. They informed me that Egg were unable to locate the Credit agreement at present. Again this went as far as a solictor, Trevor Munn, again I informed the solicitor that the account was in dispute and all went quiet again for a while.

I did make a complaint to Trading Standards in January 2008. I never heard anything from them, but interestingly it was around this time that I had my last contact with ARC/Munn and didn't hear anything else until my first contact with Cabot in November 2008.

I will start posting my correspondence from Cabot shortly, but feel like I need some really good advice now as I am reading about Cabot taking people to court and winning with the dodgiest of cases!

thanks, Saddler10

-

Hi all, very useful thread. My Egg account was sold to Cabot while in dispute. On the subject of forged notice of assignments, I have one on 'Egg' headed paper but 'signed' by someone from Cahoot/Abbey National PLC.

http://www.consumeractiongroup.co.uk/forum/debt-collection-industry/102154-saddler10-dlc-egg-3.html

-

Hi all, following with interest, my Egg card has been sold on to Cabot, despite the lack of a compliant credit agreement. As expected, Cabot are ignoring my dispute.

http://www.consumeractiongroup.co.uk/forum/debt-collection-industry/102154-saddler10-dlc-egg-3.html

-

The next thing I noticed when going through my correspondence with Cabot is very interesting/strange indeed, can't believe I didn't notice it before!

I received a letter late last year informing me that the account had been sold on to Cabot. The letter was on Egg headed paper, however below the person's signature it stated Cahoot/Abbey National plc.

A couple of weeks later I received a notice of correction from Cabot, along with the Egg letter this time with 'Egg Banking plc' below the signature. This was also a different signature to the first letter.

Not sure how significant this is but can anyone explain?

Saddler10

-

Hi, I sent a CCA request to Egg in 2007, which was never complied with. The account has passed through various DCA's before being sold on to Cabot.

The previous DCA, ARC, confirmed to me that Egg could not locate a copy of the credit agreement.

When I informed Cabot that they had purchased a debt that was disputed, they were advised by Egg that I had requested information under the Consumer Credit Act and that Egg had actioned and completed this request and there was no other dispute.

As far as I can tell, Egg have sold this account knowing they can't collect, I guess it's in their interests to tell the DCA that there is no dispute?

Saddler10

-

Hi all, sent the letter below to Cabot, but have been looking back through correspondence and have seen a couple of interesting things which I will detail in my next post.

Cabot Financial (Europe) Limited

PO Box No.241

West Malling,

Kent

ME19 4NA

dd/mm/yy

Dear Sir/Madam,

Your ref: xxxxxxxx

PLEASE NOTE- I DO NOT ACKNOWLEDGE ANY DEBT TO YOUR COMPANY

Thank you for your letter of dd/mm/yy, the contents of which are noted.

As holders of a Consumer Credit Licence you are obliged to comply with the Office of

Fair Trading Guidelines on Debt Collection. I would therefore be obliged if you

would provide me with an explanation as to why you are attempting to collect on an

alleged debt which was disputed with Egg prior to your first contact with me, and

has yet to be resolved.

According to OFT guidelines Section 2.8k "not ceasing collection activity whilst

investigating a reasonably queried or disputed debt." is considered an unfair

practice. You should consider this letter as a formal complaint, and provide me with

a copy of your complaint resolution procedure.

I also require you to confirm that you will now comply with the OFT guidelines, and

will not attempt any further collection activity whilst the dispute is unresolved.

Should you fail to provide me with the required undertaking within 7 days, I shall

report your breach of the OFT guidelines to Trading Standards and the Financial

Ombudsman Service.

As stated in my previous correspondence, the document you enclosed does not comply

with the Consumer Credit

Act 1974 Section 60 (2) and Consumer Credit (Agreements)

Regulations 1983 schedule 1 in that not all the 'prescribed' terms are present.

1. The terms 'Limit' 'Approved Limit' and 'Individual Limit' are not prescribed

terms, contrary to the Consumer Credit (Agreements) Regulations 1983 schedule 1 para

8 as the meaning of such terms cannot be exactly ascertained by the debtor.

2. The document does not state a rate of interest for cash withdrawals. The document

only states an APR, this is not sufficient and therefore another presribed term is

missing.

3. Paragraph 22 of schedule 1 Consumer Credit Agreement Regulations requires that

the agreement details the default charges payable and this document does not.

I hope that you will enter into a sincere dialogue with me about this matter and I

am writing this letter to you on the assumption that you would prefer to do this

than merely respond with standard letters and leaflets.

I would appreciate your due diligence in this matter.

I look forward to hearing from you in writing.

Yours faithfully

Saddler10

saddler10's partner v capitol one

in Capital One

Posted

This topic was closed on 11 March 2019.

If you have a problem which is similar to the issues raised in this topic, then please start a new thread and you will get help and support there.

If you would like to post up some information which is relevant to this particular topic then please flag the issue up to the site team and the thread will be reopened.

- Consumer Action Group