Sirbob00

Registered UsersChange your profile picture

-

Posts

173 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by Sirbob00

-

No you won’t loose PIP. That will be paid separately. Also as you’re over 25 you’ll get £594.04 standard allowance even though your partner is under 25. The standard rate at the moment is roughly an extra £80 per month due to COVID and is due to end April 2021.

-

Hi. yes I informed Cabot that we’d moved and the correct address shows on the credit file. Can I just ask. I was trying to find where I’d read after the default expiring 14 days after the date it’s recorded. Is this correct. So the recorded date is the 14th October but they would have until the 28th October to make a claim.

-

Thank you. I was trying to find out if the statute bar was from the missed payment or from the default date but all I could find is from the date a creditor had cause of action but I’m unsure of what that actually means.

-

Just a quick question regarding Cabot. I believe it’s for a Capital One Credit Card taken out December 2010. No payments made since April 2014. There is a default registered on my credit file dated October 14, 2014. I’ve ignored all the standard letters from them regarding the debt but is it likely they can still take me to court regarding the debt. It’s for £568. Thank you.

-

A tax rebate is counted as income when it comes to working out UC. If it’s paid through wages then UC will obviously know straight away. There is some debate though if it’s paid directly into your bank or via chq as UC may not pick up on this straight away.

-

If you move in together you’ll loose the SDP premium and you’ll have to go onto her Universal Credit claim. You would loose your housing benefit but you would get the housing element on UC. When baby is born you can claim child benefits and the child element will be added to your UC. As regards ESA if you’re in the Support Group or WRAG this should be transferred over to UC

-

Quick update Another Moorcroft letter arrived. This one says as you’ve not contacted us we have decided to look at other options. Option 1. Keep writing to you, or Option 2. Hand back to our client so they can look at other DCA to contact you. Is it OK to file with the other letters?

-

Help required regarding debts

Sirbob00 replied to Sirbob00's topic in Debt management and Debt self-help

I’m signed up to both Clearscore and Credit Karma. Should they show the same information? 2 defaults I have are my mortgage and a credit card. On CK they show as being updated monthly and the default dates, but CS says my mortgage was last updated May 2019 and the credit card in 2016 but doesn’t show the default dates just they are in default. My credit card defaulted on 14th October 2014 and my mortgage 10th September 2014. -

Home repossessed -topaz now asking for shortfall

Sirbob00 replied to Sirbob00's topic in Mortgages and Secured Loans

So there is no requirement to issue a default notice for the mortgage. Im unsure of one issued for the loan as it fell off the credit file a while ago. So the mortgage company can chase the £50,000 shortfall for another 6 years and the same with the secured loan which was for £25,000 -

Home repossessed -topaz now asking for shortfall

Sirbob00 replied to Sirbob00's topic in Mortgages and Secured Loans

dx100uk i thought it was 6 years for the interest and 12 years for the capital. Andyorch Due to our situation we advised the mortgage company we were moving out to rented accommodation. We gave them our forwarding address. As we needed to apply for housing benefits we couldn’t until the house was repossessed. I rang the mortgage company who advised they’d repossess straight away. I’m pretty sure we moved out of the mortgaged property on the 31st August 2014 and the property repossessed 10 days later and the default notice was recorded on the 10th September according to our credit file. We also had a secured load on the property which was for £25,000 started on 7th Jan 2007. That fell off our credit file a while ago. I receive yearly letters -

Hi Our home was repossessed in September 2014. On our credit file it says Default Date 10th September 2014. Should we have been sent a Default Notice? I did SAR the mortgage company and I felt the price they accepted for the property was low. The SAR indicates that they only had 1 estate agent value the property. Also the SAR shows no Default Notice was ever issued. They wrote to us after the house sold with the final balance and their intention to chase the balance. I know they can chase for 12 years but we’ve not heard from them since 2015. Many Thanks

-

Just a quick update. Another letter received on Saturday from Moorcroft just saying we can’t seem to trace that you’ve called us. Please call us so we can talk to you about repayments. That’s 3 letters in 1 week.

-

Can I ask, if in January this year we went to a NatWest branch and closed our bank account as we were advised not to use after we couldn’t pay our NatWest loan. It seems between our current account and 2 savings we had £1000. She gave us the money and closed the 3 accounts. She said she couldn’t do anything about the loan account which we obviously knew. Could they use this as us acknowledging the debt by closing the other accounts?

-

Sorry it was just the term self help that threw me. Yes I’ve used the search lots of times to help with Moorcroft and Cabot.

-

Apologies but what do you mean by self helping?

-

Does that mean once a consumer debt has fallen off your file it can’t reappear. Can Moorcroft register a default if we don’t respond? Or can NatWest register another default?

-

Sending a SAR or Moorcroft?

-

Another letter arrived today. It says we have been passed your account from NatWest and will be acting as a collection agent and we will now be dealing with your account. I know the default was registered in 2013 and the last payment I can recall being made to them was April 2014 but I’m worried about sending off the SB letter in case I missed something. Would a SAR to NatWest be ok to get this information? The debt no longer shows on our credit files.

-

Thank you. I’ll ignore. I was just curious as to why the context of the letter had change. Originally it was along the lines of We are acting on behalf of NatWest and you owe xxx amount. Please call to arrange payment. Now it’s please confirm it’s you so we can update our client.

-

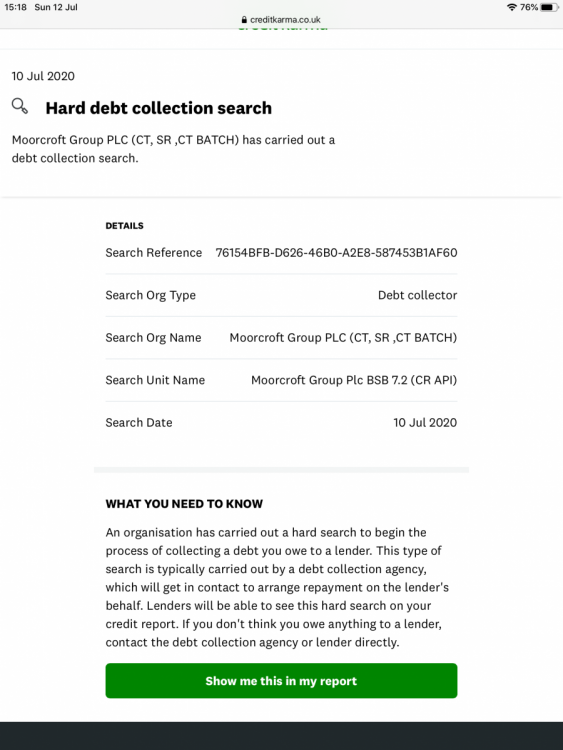

They were writing to us but we ignored them. I wrote to all creditors in January advising of the correct address. After that we heard nothing but then a credit search appeared on husband’s credit report by Moorcroft. I know NatWest got the new address as they emailed an old email address asking husband to respond confirming the address which he didn’t. I’m wondering if they done this as we didn’t sign the letters. I’m assuming that NatWest haven’t told Moorcroft of the address

-

Yes but I did inform NatWest in January of our correct address.

-

Husband received letter from Moorcroft acting on behalf of NatWest. It just says we are attempting to contact the above named person regarding a personal matter and have been provided your address as a possible address for our customer. If you are the person named above please contact us. Can I just ignore the letter?

-

Yes sorry I’ve confused you both. Ill forget about Cabot as nothing received. it was more about the Moorcroft search. Should I SAR Natwest while waiting for Moorcroft to get in touch or just wait for Moorcroft to write to him then send off the SB letter.

-

Sorry but what do you mean by dn+14 days? This is Moorcroft chasing on behalf on NatWest. The default notice was in February 2013 and last payment made via Payplan to NatWest in April 2014.

-

Received another email regarding the search. This is what it says on husbands credit report. Shall I wait to see if they write to him before sending the SB letter.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.