LordSuggs

Registered UserChange your profile picture

-

Posts

140 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by LordSuggs

-

Thanks that's really helpful - I can't locate the original paperwork, so may have to put. in an SAR on that. I'm prioritising the Sole Trader account and will clear that off before the end of the year. While waiting on the SAR I'm guessing I can't do anything with regards closing the Ltd.

-

Hi Bazza. I'm trying to track down original bank docs (can't see anything in online banking docs), but I think there was. It was the Barclays rep who said that if I progress through to Collections Department it will affect on my persona credit report. The accountant is more concerned with the Sole Trader account which is a lower amount

-

Hi all, I have 2 business accounts with Barclays - one as a sole trader which I started as and - one as a Limited Company, which I became a few years ago. Unfortunately Covid has hit my business model hard and I've made the decision to cease trading to focus on another project. The issue is that I have two overdrafts that need clearing - £1750 on Ltd and - £700 on ST both of which are accumulating bank charges. My accountant has advised I get a personal loan to pay off the debt before closing the Ltd. I've spoken to Barclays and they have said that is likely the best option as if it goes to Collections that will affect my credit. I'm wondering if anyone has any suggestions about the best option when it comes to clearing this amount - is a loan the best option or would a credit card be better? I think realistically I could clear off the balance within 3-6 months but thought I'd check here before sending out any applications.

-

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

Excellent news - the Card PPI claim has been upheld. It's about £14 less than the claim I made and they've subtracted £794 for tax, but can't complain about £7022.41 So that's two successful claims, just awaiting their calculations on the first loan. Many thanks once again gentlemen - I'm so grateful for all your help. I set up a regular monthly donation to CAG last month but will make another one off donation once the cheque clears. -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

I've received a cheque from CS for the loan PPI - £2,238.72. Banked and will give a CAG donation once it clears. Thanks guys. Also received a reply to the Credit Card PPI that I had queried. 8 weeks since my letter and they have written that due to the high volume of complaints it's taking longer than expected to respond. They expect another 8 weeks to respond of close the complaint. -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

Ok, understood. Will draw a line under that one then. Just the credit card claim to hear back from... -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

I had to look through the whole bundle of SAR files several times before I spotted it. There's nothing in the comms log, but there is a 'Case Report' which is the date they're referring to. I'm still not 100% sure I received the letter - seems somewhat familiar but I can't say definitely. Do they need a copy of it for the proof you're suggesting, or is this sufficient for them? PPI Egg.pdf -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

Gotcha - appreciate the advice -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

Nope, I've been in the same property since 2003 - this loan was taken out 2005. I think I received this letter at the height of the Shoosmiths/Arrow DCA pressure and, being honest, just got worried about responding to it. Didn't realise there was a time limit on it. Doesn't that then affect all claims? Wasn't mentioned in the first loan reply. Ok I'll shoot off a letter to them about the first loan to ask for detailed calculations and double check on the SAR tomorrow to see if they have the letter in the comms log. Thanks dx -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

I do recall receiving a letter - not sure if it was 2012, but could have been. I can't remember seeing a copy of it in the SAR but I'll double check. Definitely don't recall reading there being a time limit mentioned - is this a valid reason to reject by them if so? -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

Second one has come through and it's along the same lines. This is for the refinanced loan that was recently DCd by Arrow Global: Claim PPI payments £2836.01 8% Interest £2865.40 Total £5,701.41 Offer PPI Payments £3,365.51 Interest of payments £485.94 8% Interest £748.61 Less redress £2,388.44 Less basic tax -£149.72 Total £2,238.72 Very helpful of them to suggest I contact Arrow Global and make a payment to them! Same tactic on this one - just ask for a breakdown of their calculations? PPI2.pdf -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

I think it was more I was unsure if I could cash the cheque while also disputing the total - sounds like if it's a F&FS and I cash, that's the claim finalised. Just wanted to check as I could have sworn I saw someone give advice on here the other way. -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

First reply back - complaint upheld but far lower than in my claim: Claim PPI payments £556.10 8% Interest £794.17 Offer PPI Payments £473.55 Interest of payments £40.21 8% Interest £262.27 Less any previous rebate paid -£330.20 Unsure why their 8% is so low in comparison to the spreadsheet's calculation They've also taken out 'rebate paid' which in their notes says it's a partial refund of the premium upon early termination of the policy - I paid this loan off early. Does this make sense? Lastly, they say that if I cash the cheque they're sending I agree this is full and final settlement and can't make any further claims on this case - is that true? I'm sure I read something else to the contrary here. PPI 1.pdf -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

Yeah, I did think it was a bit of a 'kitchen sink' reply. Ok, I've spoken to my previous employer and they've directed me to the sick/absence pay terms online - 52 weeks sick pay. I'll write up a reply to CS tonight and include a printout of this. Thanks. -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

My letter to them was focussed purely on the fact that I didn't opt in to PPI for the card and was not told about it by Egg. I didn't outline all the bullets they've listed. -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

Sure - letter is uploaded. I've reached out to HR of my former employer to see if I can get confirmation. Awaiting response Canada Square.pdf -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

First reply back from Canada Square and a swift rejection of the Credit Card application. Reason: While they do acknowledge flaws in the sales process they do not accept all my allegations. However despite that, I stated that I would have received no pay from my employer if I was off work due to an accident, sickness or made redundant. Also I stated I would have had no other way of making repayments . On discussing with a former work colleague, I think I got that wrong in the application. The sick pay for my employer (major Bank) was minimum 6 months and after that it went to insurance. Is it worth me trying to get that confirmed by the employer (was c2000 so I have no idea if this is possible?) and then go back to Canada Square? -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

Great advice on the other Egg PPI thread, soI'm making my covering letters as simple as possible. Can I just check the reasons work, especially the 2005/6 loan: Egg card - never knew I had PPI, nobody told me (not on the agreement form) Egg Loan 2001 - was not told the PPI was optional (unclear from SAR if it was online application/PPI tickbox) Egg Loan 2005/6 - was not told the PPI was optional, also was self employed at time -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

Ah straight to CS - my mistake. Getting it all together now. Cheers -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

Thanks DX - amended as per your guidance. Loan 2 – Feb 2007 Borrowed £18,137.00 PPI carried over from loan 1 £2,649.62 PPI Premium £7,738.88 --------------------------------------------------------- Total Loan 2 Amount £25,875.88 PPI Rollover from Loan 1 = £2649.62 / 25875.88 * 100 = 10.24% PPI of loan 2 = £7,738.88 / £25,875.88 * 100 = 29.91% Monthly repayment = £459.98 Therefore, PPI Rollover from Loan 1 = £459.98 * 10.24% = £47.10 PPI of Loan 2 = £459.98 * 29.91% = £137.58 ------------------------------------------------------------ Just to confirm, I don't complain to Canada Square first, I go directly to FOS? The reasons I was going to put in the letter: Egg card - never knew I had PPI, nobody told me (not on the agreement form) Egg Loan 2001 - never knew it was in there, not told by salesperson (PPI is on agreement form though) Egg Loan 2005/6 - was self employed at time, implied to me PPI part of loan Sound right? Thanks StatIntSheet v101.xls -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

Blimey, really? Makes me feel even more justified in claiming this all back! Did the recalculations look better on that last one? Just pulling together letters for the first loan and CC. They all go out with separate letters yes? -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

-

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

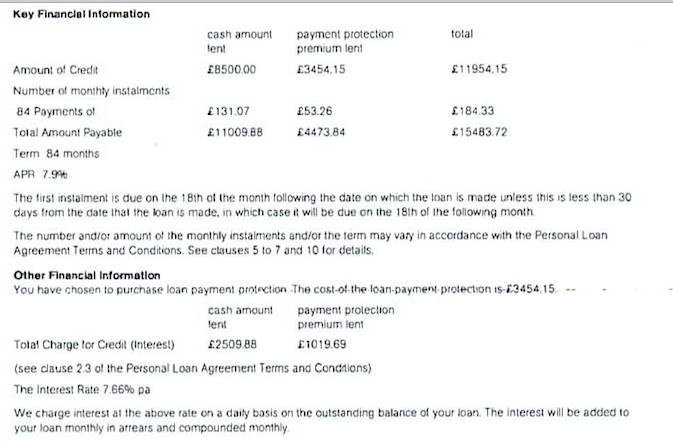

Thanks for linking to Dunnie's thread. I've copied his formatting to build my calculations out: Loan 1 – September 2005 Borrowed £8,500 PPI premium for loan 2 £ 3454.15 --------------------------------------------------------- Total Loan 2 Amount £11,954.15 PPI proportion of loan 2 = £3454.15 / £11954.15 * 100 = 28.89% Monthly repayment = £184.33 Therefore, PPI element of repayment = £184.33 * 28.89% = £53.25 14 payments of £53.25 Sep 2005 - Nov 2006 = £745.5 Payment in Oct 2006 is £204.33 with no explanation, so PPI is £59.03 Total PPI paid on Loan 1 = £804.53 PPI carried over to Loan 2: £3454.15 - £804.53 = £2649.62 Loan 2 – Feb 2007 Borrowed £18,137.00 PPI carried over from loan 1 £2,649.62 PPI Premium £7,738.88 --------------------------------------------------------- Total Loan 2 Amount £25,875.88 PPI proportion of loan 2 = (£2,649.62 + £7,738.88) / £25,875.88 * 100 = 40.15% Monthly repayment = £459.98 Therefore, PPI element of repayment = £459.98 * 40.15% = £184.68 Total PPI on Loan 2: 11 payments of £184.68 Feb 2007 - Dec 2007 = £2,031.48 StatIntSheet v101.xls -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

Gotcha - I did think it was a bit of a longshot, but no harm in checking and really appreciate the clarification. Amending the spreadsheets this afternoon. Thanks -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

Thanks - I see where I mistyped the calc - redoing it this afternoon. Re not putting in the lump sum, can I double check on this post. Loan 2 was defaulted and sold to a DCA. What I took from that post is that I put the total amount of the PPI premium from Loan 2 into the spreadsheet. Have I misunderstood here?

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

- Create New...