Scouse Paul

Registered UsersChange your profile picture

-

Posts

114 -

Joined

-

Last visited

Reputation

2 Neutral-

HPH2UK notice of transfer of old GE Capital debt

Scouse Paul replied to Scouse Paul's topic in Santander

Just for clarification, my wife has been living at the same address since 1998, all that has changed in that time is she changed her name to her now married name in 2013 -

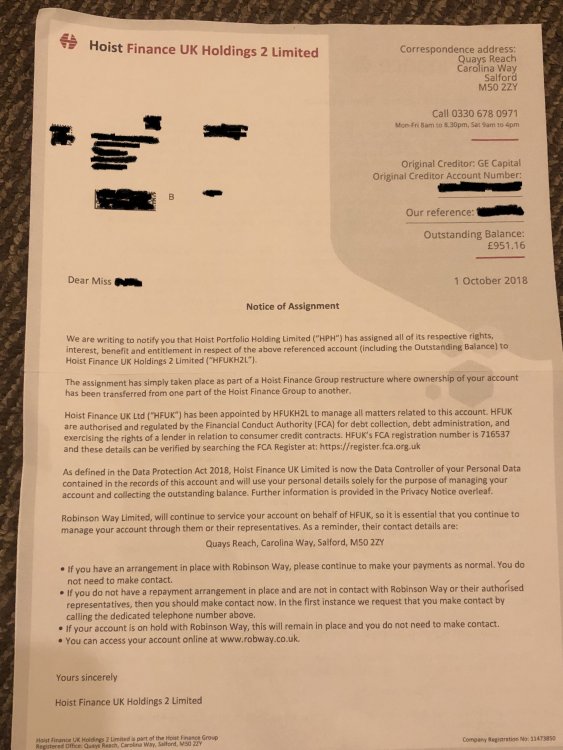

My Wife received a letter from Hoist Financial UK Holdings 2 Ltd concerning an alleged debt that my wife has with GE Capital. I have attached a copy of the letter and there are a few points I would like advice on in terms of how to proceed. 1. My wife has got no recollection of the debt in question, although she did say she once had a debt relief order, this order is coming up to 20+ years ago. 2. The letter was addressed to her in her maiden name (we have been married for 5 years and in a relationship for 6 years) and in all the time we have been together she has never had any letters from Hoist or Robinson Way who are mentioned in said letter. Should we write to them asking for proof of alleged debt, or should we just ignore the letter as it is likely to be a phishing exercise. Also should we report said companies to the ICO for being in breach of DPA as their information is very out of date as they wrote to her using her maiden name. Many thanks

-

The debt is legit, it was through the council for damages that deemed were outside of the tenancy agreement. it was for £1500 initially but its now down to just under £700, we did try referring it back to the council and offering to pay them directly but the council were not interested and said we had to deal with Collectica, couldn't be arsed to argue with council to just took the easy way out

-

Hi All, I have been paying of a debt to Collectica who were the DCA that were dealing with it, I have been up to date with payments and are not behind with them. I tried phoning them today to make the payment for December but they are now saying there is no record of the account on the system when they searched through the ref number and the address details. What should I do in a situation like this, should I just write the debt off as there is now no record of me on their system or should I wait for them to contact me in regards to the payment plan falling behind and then argue with them over their poor record keeping

-

Hi All, I recently bought some jeans on eBay, they are not the size the label claims them to be and having explained this to the seller he is adamant that he is right and won't do a return and refund. I tried to use the return option through eBay but he declined my request, should I escalate the issue through eBay or would it be better to do a charge back through my bank.

-

Sorry for the quietness, thought everything had been sorted but they are now they are going a bit too far and want to know if I can make a complaint against them to OFT etc. We received an email from them saying they accepted our repayment arrangement and £30.40 was to be paid on the 27th of each month Email was sent from them on the 23rd September. We made the payment as agreed on the 27th September electronically through my online account. Today we got a letter dated 13th October saying that due to no repayment plan being agreed and no payment being made they would commence further action with a door stop collector calling round in 7 days from the date of the letter unless we settle the balance in full. I did speak to them on the phone (convo was recorded ) and thet initially said the agreement had not being agreed by their client but when I read the email to them over the phone they changed their tune and the guy on the phone spoke to a "manager" who then said they would be honoring the agreement. Due to us having received the email and making the payment do we have ground to raise a formal complaint against them with the powers that be over the letter they sent us.

-

Payday Express Problem

Scouse Paul replied to Scouse Paul's topic in Payday Express/Wage advance/Cashtillpayday

http://www.consumeractiongroup.co.uk/forum/forumdisplay.php?336-Payday-Express-Wage-advance-Cashtillpayday Clink on that link and then click on start new thread at the top -

Payday Express Problem

Scouse Paul replied to Scouse Paul's topic in Payday Express/Wage advance/Cashtillpayday

Forgot to mention earlier and this may change the whole situation. This is the email I received from them that prompted the phone call Dear Paul, We have now written to you and tried to contact you on a number of separate occasions and have yet to receive a satisfactory response or resolution to your outstanding debt of 568.2 with Payday Express. Please be advised that repayment may continue to be attempted at any time in accordance with the terms and conditions of your Loan Agreement. Please be aware that as your account is in arrears, information will be passed to a Credit Reference Agency. This information will stay on your credit file for at least 6 years and this could affect future borrowing with other credit providers such as lenders, mobile phone or TV providers. In an attempt to have this matter resolved, we may be prepared to consider a discount on the principal balance providing you make contact with us in the next 7 days and/or agree a suitable repayment plan thereafter. In order to update your debit card details or make a payment to settle your balance you can logon to our Account Management area using the link https://applications.paydayexpress.co.uk/AccountManagement/a/Login however if there are any changes in your financial circumstances and you prefer to call then please ring us on 0115 908 1162* where one of our advisors will be happy to help. Our opening hours are 08:00 – 19:00 Monday to Friday or 09:00-13:00 Saturday. Best Regards, Express Finance -

Payday Express Problem

Scouse Paul replied to Scouse Paul's topic in Payday Express/Wage advance/Cashtillpayday

I reported my card as stolen the same day I contacted PE about the change in circumstances so no chance of them raiding my bank. Does ignoring requests to set up a repayment plan count as being treated unfairly in the eyes of the FOS? -

Payday Express Problem

Scouse Paul replied to Scouse Paul's topic in Payday Express/Wage advance/Cashtillpayday

I thought that, what would be the best way to get the repayment plan set up, as they are gonna keep requesting this information when ever I contact them, is there a piece of consumer legislation I can use against them or should I just refuse under the data protection act and confidentiality at work