valhala

-

Posts

77 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Posts posted by valhala

-

-

Hi,

Just wanted some help. I owe this lot a bit over 3K but due to being out of work not been able to pay much to them. recently been getting letters from Lewis Debt reovery who I believe are part of the company anyway?

Anyway I got a letter from them saying if I pay £1055 within 14 days then my debt to Welcome will be cleared and settled and I can apply to have it marked as settled on my credit file.

Anyway I was unable to make this sort of payment untill recently where I have now got enough to make the payment. As the offer has expired I wrote to them and told them I would be able to make the payment if they would accept it as final settlement but wanted it in writing. Today I got a letter which says

"

Dear Mr ********(obviously not going to put my name here

Re: Welcome Financial Services Ltd

We refer to your previous communications in this matter.

In response to your leter , dated Nov 20th, we would accept £1055 by the 13th December 2009 as a full and final settlement failure to do by the 13th December 2009 you will be liable for the full balance

Yours Faithfully

That is how the letter is word for word, before paying this wanted to get some advice. as it is almost 2 grand less than the balance I owe I am obviously a bit nervous that there is some sort of catch.

If I make this payment after getting the original offer and now this letter is there anyway they could chase me for the amount they have taken off??.

I plan to pay on Monday so please let me know what you think.

many thanks

-

-

hiya

have a look in here :

Payment Protection Insurance (PPI) - The Consumer Forums

also please check yur agreements to see if you were charged interest on arrangement fees,

if you have copies of your agreement a very nice man called postgg can look over them

ida x

I see on my recent loan I took out in 2006 I was charged interest on top of the insurance policy but that insurance policy has just paid out a years payments after I was made redundant in 2007 so I doubt I will be able to claim back anything from this one.

I am planning to claim back PPI on my first loan which was in 2004 but I am unable to find the agreement yet to check so I will find out

-

I originally took out a loan with these in 2004, in 2006 I needed to get another loan as I was moving into a new rented property and needed deposit so as I had almost paid of my 2004 loan(around £600 left to pay) Welcome gave me a new loan where I cleared the £600 old balance with it.

I have been out of work sicne the end of 2007 now and was lucky enough to get my PPI on my recent loan to pay a years worth of payments but during the past couple of years I have clocked up a lot of charges due to not being able to make my payments. Anyway I have just put in a claim to get my charges back from 2004 as I had quite a few on my first loan with them as well.

I am now thinking of claiming back the PPI from my first loan as this was not used and actually I didnt really need it. with it almost being six years since that first loan I guess I should get it in now before the 6 year barrier comes into place where I wouldn`t be able to claim back.

My problem is I understand the process of reclaiming charges as I have done this a few times on various accounts. but claiming back PPI is something I am not sure about. I have looked at the template letters from Martin Lewis Moneysavingexpert and read his article but I am not really sure what reason I should use as to why I am claiming back.

I have all the documents with me from the original loan and I did actually sign to have PPI added so I guess its going to make it difficult. Have Welcome had any action taken against them for the way they sell PPI as some companies have done??

Anyway any help in this matter would be most gratefull, I want to try and get this done quickly before I get into six years

-

Yeh my reply from Otelo is very strange as it starts of as

"Provisional Conclusion"

I have now reviewed your complaint about BT. After considering the evidence. My view is that BT should take certain actions to resolve your complaint. My reasons for this and the proposed remedy are set out in the attached report".

Yet there is nothing about this. The conclusion at the end is no further action.

Very strange response letter.

-

I am very annoyed. Sent my complaint to otelo after reaching deadlock with BT and today I got their report back to me with the conclusion

"I am aware that Mr Williams remained unhappy with the outcome of his complaitn ti BT. I do not consider that he recieved a shortfall in customer service in the companys handling of his complaint as his contacts appear to have been responded by telephone and in writing in a timely manner. I therefore do not consider that any action is required at this time."

What a load of rubbish, this wasn`t really my complaint about customer service it is about the way the connection charge was levied to my bill.

Is there anything else I can do?????

-

Another letter from Cabot

-

Well been pretty quiet for a couple of weeks but she recieved this letter on Friday.

-

I have been using these for years mainly because it is convenient and there is no credit checks. the interest is quite shocking though.

Anyway I am shocked to see that they are now part of the credit file, I logged into experian and was shocked to see infomation about provident on my account.

One of the main plus points about provident is that if you get behind in payments you don`t get any extra interest or charges added to your account but now obviously it is going to show on your file that you are behind in your payments.

I have almost cleared my account now anyway and certainly wont use them again but I am just wondering is there anything you can do about this.

If I had known at the start that it was going to be on my credit file I wouldn`t have taken out a loan with them probably, can they just start putting in on credit file agencies after you have taken a loan out?

-

Well Cabot have used FIRE for there next letter, in fact my ife have got two letters from FIre.

The first one says

"Due to your failure to pay the debt FIRE has now been instructed by our client Cabot Financial Group to recover the full outstanding balance on your account.

THIS NOTICE IS ISSUED FOR NON-PAYMENT OF THE ABOVE DEBT

FAILURE TO PAY YOUR DEBT WILL RESULT IN FURTHER RECOVERY ACTION

PAYMENT IN FULL IS REQUIRED IMMEDIATELY

WE THEN GOT A SECOND LETTER YESTERDAY WHICH STARTS IN BIG BOLD LETTERS "MAKE US A REASONABLE OFFER"

THEN GOES ON TO SAY AS A FINAL ATTEMPT TO RESOLVE THIS MATTER AND STOP ANY FURTHER ACION FIRE WILL GUARANTEE TO CONSIDER ANY SENSIBLE OFFER IN FULL AND FINAL SETTLEMENT OF YOUR ACCOUNT. THIS OFFER CAN BE EITHER A ONE OF PAYMENT OR A PAYMENT PLAN, PROVIDED CONTACT IS MADE WITH THIS OFFICE BY 12TH JUNE 2009

what should we do next?

-

Got a reply from Bt they say

"At the time you placed your order to have a line connected at your new property, BT idenitified that additonal exchange work and a potential engineer visit to your property would be required to connect your line. This was due to the fact that a new telephone number had to be assigned to your line and there was no previous telephone number to take over and that physical work had to be carried out at the exchange, as there was no connection there to be automatically reconnected. At the point of placing the order you were advised and accepted the charges for the work to be carried out..

THE ABOVE BIT IS NOT STRICTLY TRUE, I PLACED THE ORDER AS THE SMALL PRINT ABOUT CONNECTION CHARGES LED ME TO BELIEVE THAT BECAUSE I WOULD BE UNLIKELY TO PAY THIS AS I ALREADY HAD A BT LINE IN MY FLAT.

I WAS GIVEN A DATE WHEN THE ENGINEER WAS DUE TO COME AND MAKE THE ASSESEMENT NO ENGINEER CAME TO MY HOUSE AND THE NEXT DAY WHEN I PHONED BT THEY INFORMED ME THE LINE WAS ACTIVE AND THE ENGINEER HAD DONE WORK YESTERDAY.

WHEN I RECIEVED MY FIRST BT BILL IT WAS ACTUALLY DATED FROM 2 DAYS BEFORE THE ENGINEER WAS DUE OUT??

YOU CAN SEE WHY I AM ANGRY ABOUT THIS!!!

Anyway the letter goes on to say it is my stutory right to pursue my complaint outside BT but "AS THIS MATTER IS REGARDING BT`S TERMS AND CONDITIONS I AM NOT CERTAIN THAT YOUR COMPLAINT FALLS WITHIN OTELO TERMS OF REFERENCE"

Is this correct what they say, should I just go ahead with taking this to OTELO now??

-

1st you should Read this :- Ofcom - How to complain

Then contact BT again and say you think they should give you the same deal as they give other people, as you now feel discriminated against. Ask that if they are not prepaired to give you this deal and waive the connection fee you want a "Deadlock letter" so you can pass the complaint to Otelo

Hi, yeh the guy said he will send a deadlock letter out to me his reply is

"

Sorry to hear that you remain unhappy regarding the installation charge , I will arrange for a letter of deadlock to be sent to you. This letter clearly outlines BT’s position and provides contact details for Otelo the telecommunications ombudsman.

"

I am not going to let this go, I am very angry about it.

-

I just got an email back from someone and they are saying it clearly states on the website that a charge will be levied when taking out a BT line and my charge is correct.

I am fuming about this, not only did I wait all day for the engineer to come out(no one showed up on the day) but my bill shows the line active from a day before my line was due to be done?????

What it did actually say is a connection charge is unlikely if you already have a line and socket installed which I did.

Anyway I have write back and asked them to review the situation or I shall be making a complaint to OFCAM.

-

cheers they tend to phone every day even though we sent a couple of letters regarding their calls. My missus just blocked their number

-

I just sent an email to him, he is out of the office till the 15th May.

-

This is the next letter I have got from them in this ongoing saga. what should my next letter be?

Cheers

-

Just out of interest how do you delete a post from the thread, I cant seem to find the right icon to do it

-

It's a standard bull$hit response from Crapbot, send them this;

Dear Sir/Madam

Re:− Account/Reference

I have received the documents you sent and in the accompanying letter you have confirmed this to be a true copy of the credit agreement that exists in relation to this account. As you have sent this document in response to a formal request under Section 78 (1) of the Consumer Credit Act 1974, this statement is now binding on you as per section 172 of the Act.

I must inform you that the information received does not meet the requirements of a properly executed credit agreement under the 1974 Act.The document received does not contain any of the prescribed terms as set out in the Consumer Credit (Agreements) Regulations 1983 (SI 1983/1553) Schedule 6 Column 2.

Since this document does not contain the required prescribed terms it is rendered unenforceable by s127 (3) consumer Credit Act 1974

The absence of a properly executed credit agreement prevents you from:

Adding interest to the account

Taking any enforcement action on the account

Issuing any default notices or registering any default marker with a credit reference agency

This situation is backed by case law from the Lords of Appeal in Ordinary (House of Lords) the highest court in the land. Your attention is drawn to the authority of the House of Lords in Wilson-v- FCT [2003] All ER (D) 187 (Jul) which confirms that where a document does not contain the required terms under the Consumer Credit Act 1974 the agreement cannot be enforced.

Wilson v First County Trust Ltd [2001] EWCA Civ 633, Sir Andrew Morritt, Vice Chancellor said:

The creditor must…be taken to have made a voluntary disposition, or gift, of the loan monies to the debtor. The creditor had chosen to part with the monies in circumstances in which it was never entitled to have them repaid

In the case of Dimond v Lovell [2000] UKHL 27, Lord Hoffmann said:

Parliament intended that if a consumer credit agreement was improperly executed, then subject to the enforcement powers of the court, the debtor should not have to pay.

I would also point out that if you continue to pursue me for this debt while it is dispute you will be in breach of the OFT guidelines.

What I Require

I require all correspondence in writing from here on; any persistent attempts to contact me by phone will be reported to trading standards

I require you to produce a compliant copy of my credit agreement to confirm I am liable to you or any organisation, which you represent for this alleged debt, if you cannot do so I require written clarification that this is the case.

Should you ignore this request I will report you to the Office of Fair Trading to consider your suitability to hold a credit licence in addition to a complaint to Trading Standards, as you will be in breach of the Administration of Justice Act 1970 section 40

Since the agreement is unenforceable it would be in everyone’s interest to consider the matter closed and for you to write the alleged debt off. I suggest you give serious consideration to this as any attempt of litigation will be vigorously defended and I will counter claim for all quantifiable damages

Yours Faithfully

Print your name do not sign

Cheers, I am going to remove the letters as I realised I didn`t censor it that well

-

-

I got a reply today after sending the letter you suggested, this is what they said

-

I got a reply today after sending the letter you suggested, this is what they said

-

Unbelievable thing happened where my wife had an account with a catalogue missed payments and then had the account sent to a DCA, she didnt realise anything about this untill she got a phone call last week from a guy up in yorkshire somewhere(we live in the south) saying he has been recieving statements and letters about the account, he even mentioned some of the items my wife has purschased.

A couple of days later she got a call from the company apologising and saying they will look into what has happened. My wife has said she wants the balance cleared and accouunt closed as she was in the process of claiming default charges which should have come to the amount left on the balance living it at zero.....she probably has a default notice on her credit file now as well.

Anyway need some advice here, they have obviously done an error, but in my opinion its quite a serious error as giving her infomation to a complete stranger could have had a much more serious outcome, luckily the guy seemed quite genuine as he phoned to let her know about it and also called the company to inform them.

Any advice much appreciated ??

-

The letter above still stands, I could magnify your original post enough to spot a dud at a thousand yards.

Thanks for your help mate. Should I send the lette about phone calls seperately?

-

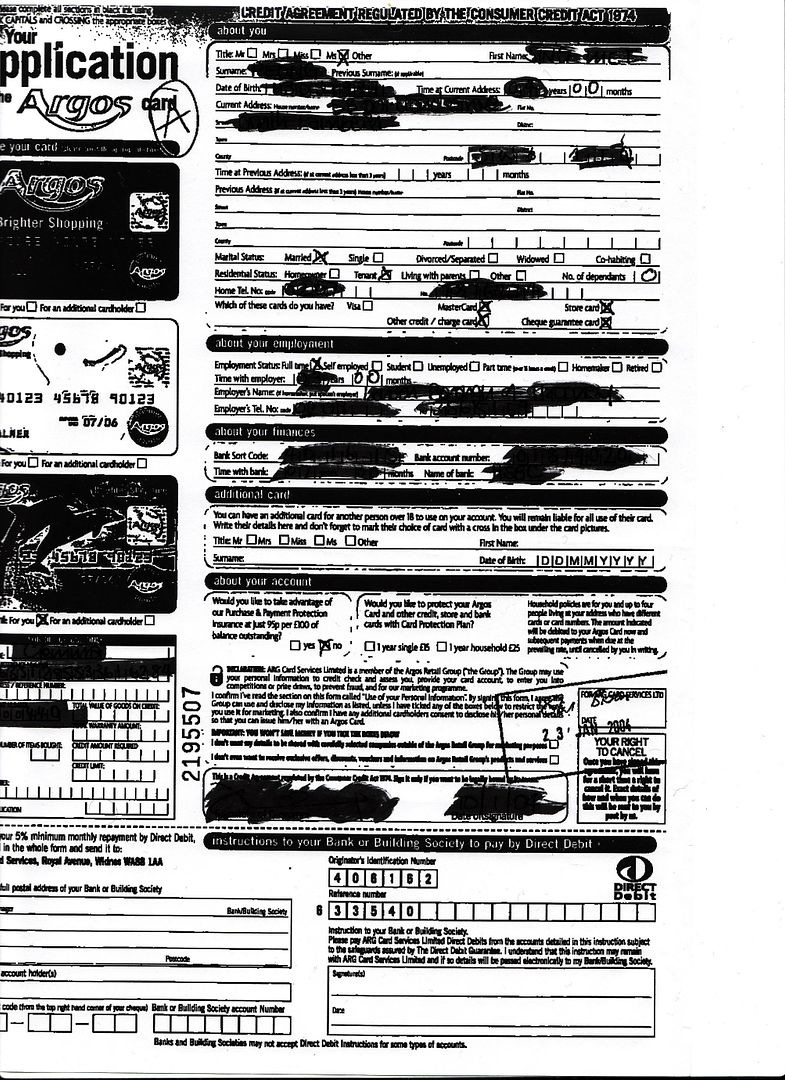

This is the copy of the agreement they sent

Valhala Vs Welcome Finance.

in General Debt Issues

Posted

I must stress this offer has nothing to do with my claiming PPI. I didnt actually start that in the end. I just got an offer out of the blue saying I have been selected to clear the debt if I make this payment.

I just wanted to make sure they is nbo hidden catch if I pay it. Dont wnat to make the payment then hear from Welcome Saying I still owe 2 grand